Businesses are often contemplating their choice of ERP vs. Accounting Software. If a small firm is doing well, it will soon outgrow its primitive systems and procedures. Excel spreadsheets and paper records won't cut it for a firm that has gone from dozens to hundreds, then thousands, of orders, as well as expanded into new locations and hired more employees.

However, many business owners and managers are unsure whether they require accounting-only or more comprehensive software. Therefore, it is common practice for businesses of this type to compare and contrast ERP vs. Accounting Software.

What Is ERP?

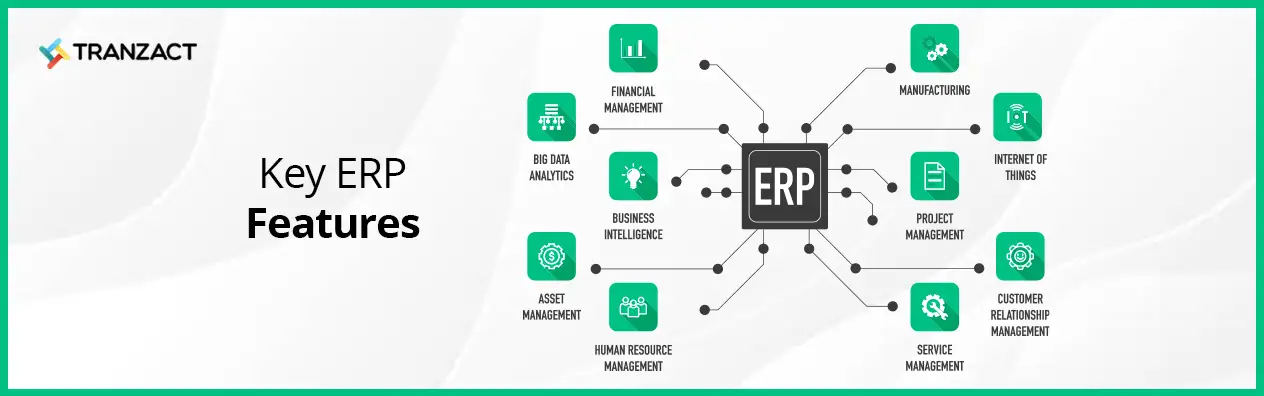

ERP, or enterprise resource planning, is a collection of programs designed to help companies manage virtually all facets of their operations. Accounting, human resources, production, marketing, sales, and the supply chain are just a few of the many areas that provide data to ERP systems' databases.

Therefore, ERP systems allow company managers to automate operations and get insights across departments by providing a single picture of organizational data. ERP solutions allow business leaders to streamline operations and find places for efficiency gains.

What Is Accounting Software?

Accounting software, by definition, is designed to handle the financial aspects of a business such as its bookkeeping, payments, and receipts. For instance, a trial balance, a crucial aspect of double-entry bookkeeping, is easier to create with the aid of an accounting system. Financial statements, such as income statements, balance sheets, and cash flow statements, are all made easier to compile with the use of accounting software.

ERP Vs. Accounting Software - Major Differences

Comparing the features of ERP vs. Accounting Software in terms of coverage and scope is essential for making the case that these two types of systems serve distinct purposes. Following are the key differences between ERP vs. Accounting Software:

| ERP | Accounting Software |

|---|---|

| ERP is a comprehensive software that integrates multiple business functions like inventory, sales, and production, finance, human resources. | Focused primarily on financial management and accounting tasks. |

| Provides a centralized database that allows real-time data sharing and collaboration across different departments. | Typically limited to financial data and may not have extensive integration with other business processes such as inventory and production. |

| Supports complex business operations and can handle large-scale organizations with multiple locations or subsidiaries. | Suited for small to medium-sized businesses with basic accounting needs. |

| Offers advanced reporting and analytics capabilities for strategic decision-making. | Provides basic financial reporting and may lack advanced analytical features. |

| Customizable and scalable to accommodate unique business requirements. | Generally less customizable and tailored for standard accounting processes. |

| Higher cost due to its broader functionality and implementation complexity. | Lower cost and easier to implement compared to ERP systems. |

| Having understood the difference between accounting and ERP software solutions, businesses can evaluate ERP software for accounting vs ERP as a standalone based on their needs and requirements. |

The Optimal Reasons to Implement an ERP System

As businesses grow and evolve, it becomes crucial to move away from ad hoc processes and adopt a more systematic approach. Storing inventory in the founder's garage and managing orders through spreadsheets may no longer be feasible. With ERP's versatility, including supply chain management, customer relationship management (CRM), and human resources (HR) modules, it becomes an ideal choice for expanding businesses.

By implementing an ERP system, businesses gain the ability to track various processes and functions seamlessly, providing a holistic view of the company. This not only improves efficiency but also simplifies complex processes like the order-to-cash cycle, eliminating delays and reducing errors. With ERP's centralized data storage and interconnectedness, businesses can enhance manufacturing planning, automate the supply chain, and make informed decisions based on consolidated information.

Benefits of using ERP software

The following are the important benefits of ERP software:

Lower expenses for information technology

In most cases, just a single IT department is needed to oversee the ERP system and license. With everything in one place, businesses may cut down on user onboarding and retraining efforts. Overall, this reduces IT expenditures since just one system needs to be learned by staff members, rather than multiple.

Prompt updates and responses

Businesses can gain from ERP's real-time data updates and modification capabilities. This ensures that all members of the team have the most recent data at their disposal at all times so that they can produce accurate reports and make well-informed choices.

Enhanced cooperation

By reducing or eliminating the need for teams to share and explain information, ERP may foster cooperation between divisions. This is because the data is readily accessible within the ERP system. Managers and HR specialists may monitor the development of all engaged employees and divisions as teams launch initiatives using real-time data.

Efficiency and output

As a result of the automation of many business operations made possible by ERP software, companies may save both time and resources.

When it comes to payroll, an ERP system can handle duties like calculating wages and managing deductions for benefits mechanically. ERP automation can free up workers' time to focus on more important work by handling routine chores that occur numerous times each month.

Improved customer attention

ERP systems can help businesses monitor shipments and orders to guarantee timely delivery. If the system flags a possible shipment delay, for instance, the team may look up the order, figure out what's causing the holdup, and let the client know. Improvements in customer service, in turn, can lead to stronger bonds between a company and its clientele.

Benefits of using accounting software

The following are the important benefits of accounting software:

Save money

Accounting software has the benefit of being relatively cheap. The price of accounting software is often far lower than that of an enterprise resource planning system. For instance, a big technology or retail firm may spend tens of thousands of dollars to build an enterprise resource planning system.

The cost of more sophisticated accounting software, on the other hand, can vary from a few dollars to several hundred each month, depending on a company's budget and volume of transactions.

Superior adequacy

ERP systems are all-encompassing frameworks with many valuable capabilities, but small and medium-sized businesses may not require all of the supplementary services. A more compact and targeted set of features offered by accounting software may better suit the demands and objectives of such businesses.

Enhanced familiarity

Regular users of accounting software may notice some commonalities across different packages, which can make switching between them easier. For this reason, many small and medium-sized businesses may find that accounting software with recognizable and user-friendly features is a better fit for their needs.

More quickly put into action

The time it takes to set up and deploy software for financial management practices can be reduced because of the ease with which several accounting apps can be integrated.

Accounting and finance software may be installed and integrated into a corporate system in as little as a day. Integration of more complex accounting software may take many weeks. When compared to the time required to roll up a comprehensive ERP system, this is a significant saving.

Simple usage

Learning how to utilize accounting software is usually straightforward. The majority of operations just need data entry, while others, like the posting of statements and invoices, may be automated. Many different types of professionals are frequently capable of using the system with minimum training due to the intuitive nature of many accounting software packages.

The decision of accounting vs. ERP software is one of the most crucial decisions for SMEs and they should consider all key factors before deciding on it.

Which One Is Best For Your Business?

Integrated company management software is growing increasingly popular, and as a result, traditional accounting software is becoming less common. The convenience offered by ERP software in handling end-to-end operations makes it a preferred software for growing businesses.

But if your company chooses to maintain its financial records apart from the rest of its operations, or if it has specific accounting requirements that can only be met with a standalone system, then a standalone accounting solution is the way to go.

TranZact offers cloud-based ERP solutions and also offers integration with Tally and BUSY accounting software so that a business that wants to upgrade to an ERP can still continue using its existing accounting applications. It does not have to worry about the hassles of shifting all its financial and accounting data from one system to the other.

This makes TranZact the best ERP accounting software in India with accounting integration for SME manufacturing businesses.

FAQs on ERP vs. Accounting Software

1. Why are ERP systems so important for accountants?

ERP systems provide accountants with 24/7 access to a centralized database, eliminating the need for separate marketing and accounting systems and reducing manual data entry. With comprehensive ERP software, data is transmitted rapidly and automatically, ensuring the accuracy and consistency of accounting data at all times.

2. What are finance and accounting in ERP?

ERP's accounting and finance module is equipped with unique features designed to streamline all of your firm's financial processes. Some examples of these tasks are recordkeeping, asset management, money handling, report writing, and financial data analysis.

3. How is ERP used in accounting?

Workflow and other time-saving technologies inherent in an ERP for accounting administration reduce the need for manual data entry and automate the accounting processes of a business. It streamlines processes related to accounts payable and receivable, which avoids cash flow issues and improves cash management.

4. Is an ERP the same as an accounting program?

While accounting programs focus primarily on financial transactions and record-keeping, an ERP (Enterprise Resource Planning) system encompasses a broader range of functionalities. This includes accounting but also extends to other areas such as supply chain management, human resources, and customer relationship management. ERP provides a more comprehensive solution for managing an organization's resources and operations.

5. What is the difference between ERP and accounting software?

Accounting software has limited capabilities in terms of real-time monitoring and portability. With ERP, all financial dealings are stored in one central location. ERP systems provide an integrated strategy for many different types of corporate activities, reducing the need for several tools to satisfy the demands of different departments.