Best GST-Compliant Software for Manufacturers

Free forever

Real-time reporting

Data Security

24 X 7 Support

GST Number Search Tool - GSTIN Verification Online

TranZact's GST number search tool offers a convenient and cost-free way to perform a GSTIN verification. Our tool allows you to effortlessly conduct a GSTIN search with just one click. With our GSTIN search tool, you can easily verify your GST number and conduct GSTIN verification.

Verifying a registered taxpayer's validity using their GST Search number is important. Through the GSTIN search tool on our website, you can quickly identify a fake and an invalid taxpayer. You will be able to receive the proper input tax credit with GST status verification, which cannot be verified if the GST number is incorrect. The GSTIN search toolbar or GST number check from TranZact is a user-friendly tool for a hassle-free experience. Checking a taxpayer's GST number is essential to ensuring their legitimacy, which helps to ensure that the tax collected moves through the GST supply chain and that cascading of the tax impact is prevented.

Table of Contents:

- What Is the GST Identification Number (GSTIN)/GST Number?

- Why is it Important to Verify GSTIN or GST Number?

- GST Identification Number Format?

- TranZact's GST Number Search Tool

- How to use TranZact's GST Search Tool and GSTIN Validator?

- Benefits of an Online GST Search & Verification Tool or GSTIN Validator

- Where and How to Complain About Fake GSTIN?

- Stay Ahead and Stay Alert!

- FAQs

What Is the GST Identification Number (GSTIN)/GST Number?

GSTIN or Goods and Services Tax Identification number is a 15-digit alphanumeric code to identify every taxpayer registered under Goods and Services Tax (GST).

It is a PAN-based unique number that helps to track a registered taxpayer. In addition to the GSTIN, a GST taxpayer gets a GST registration certificate.

Thus, your GSTIN represents you under the GST tax regime. You can even have multiple GST numbers. It depends on the states or union territories where you operate your business.

The previous tax regime required multiple registration numbers like VAT, Service Tax, and Excise. But, things are no longer complicated because GSTIN has replaced the other registration numbers.

You have to register yourself under GST on crossing a threshold limit of income.

Why is it Important to Verify GSTIN or GST Number?

GST identification number search and verification is crucial as it helps you to check the authenticity of a taxpayer. That's what makes it so indispensable for businesses.

You can check whether your vendors are authentic taxpayers before signing a contract. That will help you do business ethically and be a responsible citizen.

Some vendors often manipulate their GSTIN to avoid tax payments. So, verifying the GST with a GST search number tool will let you understand if the vendor's invoice is genuine.

Moreover, GST verification helps you file correct tax returns for a given tax period. Plus, it lets you claim your Input Tax Credit, which you lose in case of incorrect or fake GSTIN.(Input Tax Credit lets you deduct the tax you have already paid on the purchase of goods while paying taxes during the supply of goods.)

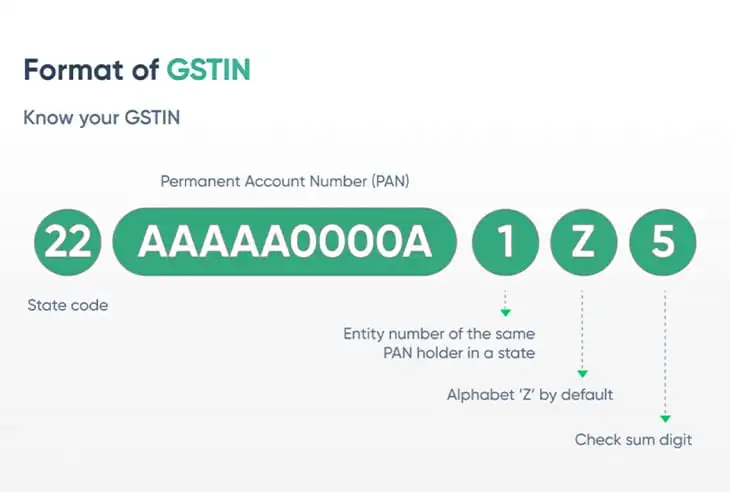

GST Identification Number Format?

Even before conducting a GST search number check and assessing the validity of the GST number, you can determine whether it is in the correct format. The GST number structure consists of 15 characters. And here's what the 15 characters of a GSTIN stand for -

- The first two numbers indicate the state code of the registered GST taxpayer.

- The next 10 characters show the PAN number.

- The next number is the entity number of the same PAN holder in a state.

- The next character will always be the alphabet Z (by default).

- The last character is usually a number, which is a check code for the detection of errors.

TranZact's GST Number Search Tool

TranZact's GST number search tool lets you check the GSTIN authenticity with a single click. You can search any GST number and verify whether it is genuine and valid. Thus, it prevents you from doing business with vendors having fake GSTINs

This GST search tool is free of cost. So, it comes in handy for your business whenever you want to check the authenticity of a vendor.

How to use TranZact's GST Search Tool and GSTIN Validator?

Using TranZact's GSTIN verification tool is easier than you could imagine.

- Enter the GSTR number in the search box.

- Click on the search button. And you will see the results of the GST search number.

You will get the following details if the GST number is valid.

- The registered name of the business

- The place of operations (principal and additional)

- Date of registration of the business

- State of jurisdiction

- Business constitution and composition (whether company, sole proprietorship, or partnership)

- Type of taxpayer (regular or composition dealer)

- Status of GSTIN

- Cancellation date (if available)

After a successful GST number check and GST status verification, you can proceed to make a business agreement with the vendor or clear their invoice. Plus, you can go ahead with filing your GST returns too.

Benefits of an Online GST Search & Verification Tool or GSTIN Validator

GSTIN search number check using an online GSTIN search tool has numerous advantages:

- Helps to check the authenticity of any GST number

- Lets you verify if the GSTIN on a hand-written invoice is fake

- Helps you avoid a GSTIN fraud

- Prevents you from getting into business deals with vendors having a fake GSTIN

- Lets vendors correct any errors in GSTIN reporting

- Ensures your hard-earned money goes into the right pockets (and saves you from tax default)

Where and How to Complain About Fake GSTIN?

You must check the GSTIN in a GST number search tool before clearing any invoice. If you see that the GST number is fake or invalid, you can always complain to the competent authority.

You can file your complaints at the GST complaint portal. It is an easy process where you don't need to write emails or make calls. Just follow these steps -

- Enter the keyword related to your complaint in the 'Type the Issue or Concern' box.

- You'll see a list of problems related to the given keyword. Select your specific problem.

- The system will provide some FAQs related to the issue. Read them and see if they solve the issue.

- If the FAQs don't solve your problem, you can file a complaint.

- Click on 'No, I want to lodge my complaint.

- You will get redirected to a page where you have to type the issue.

There you go! You have successfully lodged your complaint.

Stay Ahead and Stay Alert!

Now that you know how to verify a GST number, you can run your business efficiently. Performing a GST number search before every business transaction will help you stay away from fraud.

TranZact's GST number search tool lets you verify a GST number within seconds. You can also conduct a GST number search by company name or PAN. Check out the tool now and make your business operations more smooth and profitable!

FAQs

Can you search GST number by name?

Yes, the GST search by name tool lets you search for GST number by name. However, the best way to check the authenticity of the GSTIN is by the GST number itself.

How to find name from GST number?

When you enter the GSTIN in TranZact's GST number search tool, you will get the name of the vendor.

Can we find the owner's name from GST Number?

Yes, you can find the owner's name with a GST number verification tool. When you enter the GSTIN, the registered name of the owner gets displayed.

Can we find the company's address from GSTIN?

Yes, you can find the place where the company operates through a GST number check.

How to check whether the GST number is active or not?

Any GST number search tool can help you check whether a GST number is active or not. You will get the details of the business if the GSTIN is active. Otherwise, the tool will display an error message.

How to find GST number by PAN?

The GST number search by PAN feature helps you search the GSTIN if you have the PAN number. But it is based on trial and error. So, the best way of GSTIN authentication is with the GST number.

What are the uses of GSTIN?

Your GSTIN acts as proof that you pay the Goods and Services Tax. It is also an identification number that proves the authenticity of a vendor. Moreover, you can easily get a business loan if you have a GST number.

Can you hold multiple GSTIN or GST numbers?

Yes, you can have multiple GST numbers. You require separate GSTINs for every business you own or for every location your business operates in.

Is it mandatory to mention GSTIN on invoices?

It is mandatory to register for GST when you cross a certain threshold of revenue. If you are registered under GST, you must mention your GSTIN in all your invoices.

Table of Contents:

- What Is the GST Identification Number (GSTIN)/GST Number?

- Why is it Important to Verify GSTIN or GST Number?

- GST Identification Number Format?

- TranZact's GST Number Search Tool

- How to use TranZact's GST Search Tool and GSTIN Validator?

- Benefits of an Online GST Search & Verification Tool or GSTIN Validator

- Where and How to Complain About Fake GSTIN?

- Stay Ahead and Stay Alert!

- FAQs

TranZact is a team of IIT & IIM graduates who have developed a GST compliant, cloud-based, inventory management software for SME manufacturers. It digitizes your entire business operations, right from customer inquiry to dispatch. This also streamlines your Inventory, Purchase, Sales & Quotation management processes in a hassle-free user-friendly manner. The software is free to signup and gets implemented within a week.