An E-Way bill or Electronic Bill is the bill required by transporters whenever they move goods worth Rs. 50,000 or more across the country. This bill can be easily generated by accessing the government-managed E-Way Bill Portal. Once generated, you will receive a unique E-way Bill Number (EBN). It is important to know that even unregistered suppliers or manufacturers need an E-way bill.

Just as you can generate an e-way bill you can carry out e-way bill cancellation too. Also, there is an alternative way to either generate or cancel e-way bills. Both bill generation and cancellation can be done via SMS, Android apps, and site-to-site integration via an application programming interface (API).

In this article, you will understand the e-way bill cancellation procedure, e-way bill cancellation rules, e-way bill cancellation FAQs, and steps to cancel an e-way bill.

Understanding the Need for Cancelling an E-Way Bill

There might be several situations for businesses when they need to cancel E-Way Bills online. You must be wholly aware of these situations to make a smooth transition of your goods. You can cancel your e-way bill if the goods have not been moved or shipped. Sometimes due to a mismatch in the goods mentioned on the e-way bill and that transported, cancellation of the e-way bill is required.

Consequences of Not Cancelling an E-Way Bill

A business owner may face severe consequences if he does not generate an e-way bill. Similarly, if he does not move the goods as per the bill generated then he must make sure that it has to be canceled, failing which he may have to face penalties.

Let's understand the e-way bill cancellation procedure. If the goods are not transported, the e-way bill has to be canceled within 24 hours from the time of generation. If that is not done, then the system will not allow the consignor to cancel after that period.

After that, he can request the recipient to reject the bill from his end within 72 hours. Post this time; there is no way the bill can be canceled, as per the e-way bill rules of the government.

Eligibility for Cancelling an E-Way Bill

Who Can Cancel an E-Way Bill?

As per E-way bill cancellation rules, the person who generates the e-way bill can cancel it within 24 hours, or else the recipient can reject it within 72 hours.

When Can an E-Way Bill Be Cancelled?

There are certain procedures to be followed even if you have eligibility for e-way bill cancellation. You can cancel e-way bills online when you have made a mistake by wrongly entering the tax value of taxes such as SGST, CGST, or IGST. SGST refers to State Goods and Services Tax, CGST refers to Central Goods and Services Tax, and IGST refers to Integrated Goods and Services Tax.

You are eligible to cancel the e-way bill if you have made an incorrect entry of your GSTIN, PIN codes, or HSN code numbers. Also, as mentioned above, the bill can be canceled when there is a mismatch of data or when the goods have not been transported at all.

Steps to Cancel an E-Way Bill

You must note herein that once you generate an E-way bill, you cannot under any circumstances delete the bill. If there is anything wrong or inaccurate you can, you can cancel it and generate a fresh bill. To cancel your old E-way bill, all you need to do is follow the below-given steps to cancel an e-way bill:

- For the cancelation of the e-way bill, the generator of the e-way bill must have the E-Way Bill number ready in hand. You can then log in from the site wherein the "Cancel E-Way Bill" screen will appear which you must select.

- Once this step is completed you will receive an OTP on the registered mobile number along with the 12-digit E-Way Bill Number. Click the "Get OTP" button and again click on "Verify OTP".

- The next step involves providing the reason for your cancellation which should be a valid reason for cancellation.

- Lastly, when every procedure is completed, you can submit your E-way bill for cancellation.

Points to Remember While Cancelling an E-Way Bill

There are a few points that you must bear in mind while canceling E-way bill. If you bear them properly then you should not have any problem canceling your bill or even after cancellation. The points are:

- There is a time limit for canceling your bill which is 24 hours from the generation or within 72 hours by the recipient of the bill.

- You can make a cancellation for partial goods.

- There is a cancellation for different modes of transport.

- When wrong information inputs have been entered, you can get the bill canceled.

Manage E-Way Bills Seamlessly!

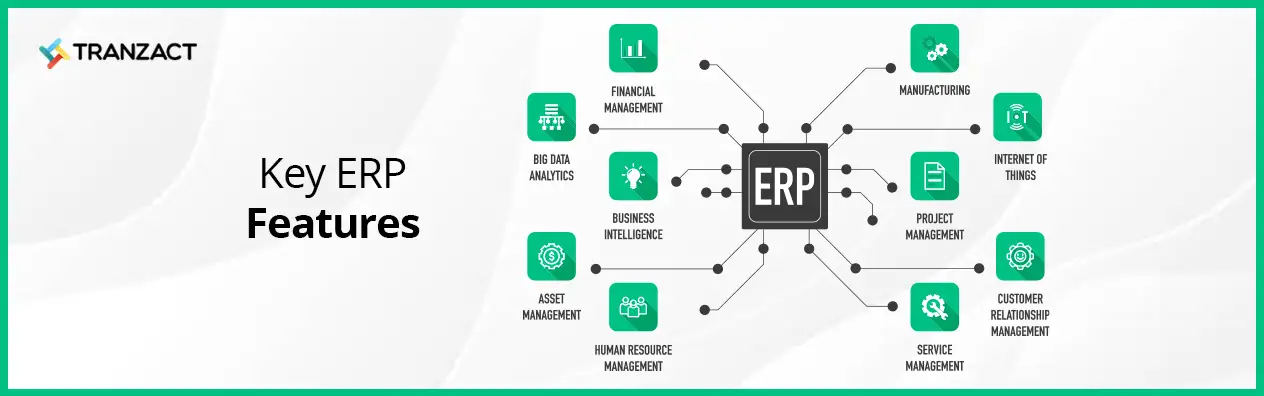

Whether you want to generate or cancel E-way bills, you can rely on TranZact. It is a cloud-based software trusted by over 10,000 SME manufacturing companies. TranZact offers GST complaint e-way bill creation in a single click, thus facilitating you to save valuable time. TranZact's software also offers an inventory management module, production planning module, and accounting integration for end-to-end business automation.

FAQs on How to Cancel E-Way Bill

1. What happens after the e-way bill is canceled?

When the e-way bill is canceled you can under no circumstances use that bill. You will have to generate a fresh bill for further business purposes.

2. Can an E-way bill be canceled after the goods have been transported?

No, once the goods have been transported, an E-way bill cannot be canceled.

3. Is there a fee for canceling an E-way bill?

No fees are required for canceling an e-way bill.

4. In what case is an E-way bill not needed?

In many cases, an E-way bill is not needed. For example:

- When the transportation is not done by a motor vehicle.

- When goods are transported from a customs port, airport, or air cargo complex for customs clearance.

- When goods are transported under customs supervision.

- Cargo in transit shipped to or from Nepal or Bhutan.

- Movement of goods under the Ministry of Defence.

- Goods transported by rail by the Central Government, State Governments, or local authorities.