If you're wondering how to generate E-Way Bill, you're at the right place. An E-Way bill is an electronic-way bill for the transportation of goods, which is used to track the flow of goods and prevent tax evasion in accordance with the Goods and Services Tax (GST) regulations. Both registered GST taxpayers and unregistered individuals who are involved in the supply of goods must generate an E-Way bill.

An E-Way bill is mandatory for registered persons or taxpayers who transfer goods or cause the movement of goods with a value exceeding ₹50,000, whether in relation to a supply or for any other reason. It is also mandatory for an unregistered person who is involved in the inward supply of goods. The conditions under which an E-Way bill is mandatory are specified in the GST laws and regulations and the E-Way bill system. In this article, we'll see how to generate E-Way bills on the E-Way bill portal, along with other key related factors.

Prerequisites for E-Way Bill Generation?

You must meet the following prerequisites to the E-Way bill generation process:

-

One of the following documents - bill of supply, invoice, or challan registration on the E-Way bill platform.

-

If traveling by road - An ID of the transporter or the vehicle number.

-

If traveling by train, ship, or air - An ID of the transporter, transport document number, and a date on the document.

How to Generate E-Way Bill on E-Way Bill Portal?

To generate an E-Way bill, follow these steps:

-

Log in to the E-Way bill system.

-

On the dashboard's left-hand side, click 'Generate new' under 'E-way bill.'

-

On the screen that appears, enter the necessary details, such as transaction type, sub-type, document type, document number, document date, from/ to details, item details, and transporter details.

Transaction type:

You need to select 'Outward' if you are the supplier of the goods or 'Inward' if you are the recipient.

Sub-type:

This field will appear based on the transaction type selected. For an 'Outward' transaction type, the subtypes that will appear are - Exports, Sales Returns, Skd/Ckd (Semi knocked down condition/Complete knocked down condition), Job Work, For own use, or Others.

For an 'Inward' transaction type, the subtypes that will appear are - Imports, Purchase Returns, Skd/Ckd (Semi knocked down condition/Complete knocked down condition), Job Work, For own use, or Others.

Document type:

You need to select the type of document that you are generating e-way bill for. You can choose from options such as 'Invoice,' 'Bill,' 'Challan,' 'Credit Note,' 'Bill of Entry,' or 'Others.'

Document number:

Enter the document or invoice number for the document type selected in the previous field.

Document date:

Select the date of the document or invoice. Note that the system will not allow you to select a future date.

From/ to:

Depending on whether you are the supplier or the recipient, enter the 'From' or 'To' details. If the supplier or client is unregistered, mention 'URP' in the field GSTIN, indicating that the supplier/client is an 'Unregistered Person.'

Item details:

In this section, you need to add the details of the consignment, HSN code-wise. Enter the product name, description, HSN code, quantity, unit, value/taxable value, and tax rates of CGST and SGST or IGST (in %). Enter the tax rate of Cess, if any, charged (in %).

Transporter details:

Enter the mode of transport (Road/rail/ship/air) and the approximate distance covered (in kilometers). You can either enter the transporter name, transporter ID or transporter doc. no. & date, or enter the vehicle number in which the consignment is being transported.

Click 'Submit,' and the system will generate an E-Way bill in Form EWB-01 with a unique 12-digit number. You must print and carry the E-Way bill (EWB) during transport.

Note that you can update the 'My masters' section to add frequently used products, clients or customers, suppliers, and transporters before generating an E-Way bill. Also, you must mention the mode of transport and approximate distance covered, either the transporter details or the vehicle number in which the consignment is transported.

How to Generate Bulk E-Way Bills?

In the above section, we saw how to generate an e-way bill. A user can also create e-way bills and generate bulk e-way bills by following this process:

-

Consolidate multiple e-way bill files into a single file format, JSON, to make it easier to manage and process the information. You can create a JSON file either by using an EWB bulk converter or spreadsheet software.

-

On the e-way bill portal, click on the 'Generate Bulk' option, which is right under the e-way bill option.

-

A new window will open, and you'll be prompted to upload the JSON file you created in the first step.

If no errors are found in the JSON file, the platform will generate bulk e-way bills.

Latest Updates on E-Way Bills

a. The inter-state movement of goods in India has seen an increase in the generation of e-way bills since its implementation on April 1, 2018.

b. From May 1, 2021, to August 18, 2021, taxpayers who had not filed GST returns for the months of March to May 2021 would not face any blocking of their e-way bills.

c. However, the blocking of e-way bills for non-filing of GST 3B resumed on August 15, 2021.

d. Starting June 1, 2021, any GSTIN that has been suspended will not be able to generate an e-way bill.

e. To make it easier for the movement of goods and updating of vehicle details, the mode for ODC or Open Delivery Challan has been changed from 'Ship' to 'Ship or Road cum Ship.' This change has been made so that users can enter vehicle details even if the goods were originally transported by road.

f. However, certain states, such as Tamil Nadu, provide exemptions for E-Way bill generation for transactions under a certain monetary threshold. For example, in Tamil Nadu, transactions worth less than ₹1 lakh are exempt from E-Way bill generation.

To stay informed on such exemptions, one can visit the state-wise E-Way bill rules and threshold limits page or check the commercial tax websites of the respective states or Union Territories.

Simplify the E-Way Bill Process

Knowing how to generate E-Way bill online is a crucial aspect of inter-state and intra-state transportation of goods in India. The e-way bill process is simple and can be completed online through the E-Way bill portal. It is important to ensure that all the necessary GST invoice details are entered accurately to avoid any legal implications.

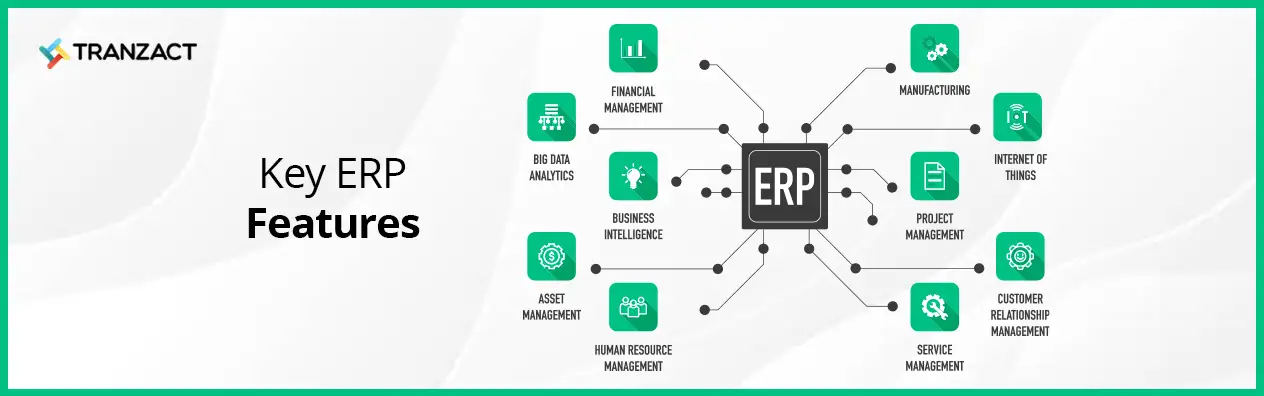

The implementation of the E-Way bill system has made transportation more efficient and transparent, leading to a reduction in transportation costs and delays. With the information provided in this blog, you can now generate an E-Way bill with ease and ensure that your goods reach their destination smoothly. If you want to further automate the generation of e-way bills, you can upgrade your invoicing and accounting processes on TranZact. With TranZact you can automate your e-way billing activities easily and cost-effectively in a few clicks!

In addition to assisting you on how to generate e-way bills, TranZact also provides production planning and inventory solutions along with advanced integration with accounting software such as Tally and BUSY for business convenience!

FAQs on How to Generate E-Way Bill

1. When is an E-Way bill generated?

An E-Way bill is generated when the goods are ready to be shipped. It can also be generated when the transactions are non-supply, such as the following:

- Export or import

- Job work

- Return of goods

- Semi or completely knocked-down supply

- Supply of goods for fairs or exhibitions

- Goods for personal consumption

- Sale on the basis of approval

2. How to print an E-Way bill through the E-Way bill portal?

Under the E-Way bill option on the dashboard, you can click on the 'Print EWB' option, enter the E-Way bill number, and click on 'Go.'

3. How to unblock your E-Way bill ID?

Your E-Way bill ID will be blocked if you haven't filed your returns for two consecutive tax periods. This prevents you from generating your new E-Way bills. So to unblock your ID, file your GSTR-3B form and wait for 24 hours.