AP automation software simplifies accounts payable processes and improves speed. It removes manual work and cuts down on errors. This is achieved through features like automated data capture, invoice matching, approval workflows, and electronic payments. These elements make invoice processing faster and help maintain vendor relationships.

Organizations get valuable financial insights from AP automation. It makes the AP function more accurate, efficient, and cost-effective, which benefits the whole financial management. Using AP automation not only helps companies understand their finances better but also makes money management smarter and more efficient. It lets the people in charge of money focus on important things instead of boring tasks. This helps them get more done and make better decisions with the money.

What Is Accounts Payable Process Automation?

Accounts payable process automation means using technology and software to simplify and improve tasks related to managing a company's accounts payable. Traditionally, the AP process involves:

- Manual entry

- Paper-based invoices

- Time-consuming tasks

Another aspect of AP automation involves using digital pathways to approve invoices and handle payments. This makes the whole process easier and quicker, as everything happens online. It reduces the need for manual steps and frees up time for other important tasks. Overall, electronic workflows contribute to a smoother and more efficient accounts payable process.

What Are The Benefits Of AP Automation?

Using computers to help with money can make businesses faster and more accurate. There are many benefits of AP automation. Let us get to know them a little bit:

Enhanced Speed and Time Savings

Automating accounts payable (AP) can improve speed and save time. Using AP also helps you see your finances better so that you can make smarter decisions.

Improved Accuracy and Reduced Errors

Manual data entry can make mistakes. AP automation reduces this risk with the help of Optical Character Recognition (OCR) technology. Automated systems also match invoices, ensuring accuracy in Matching invoices with purchase orders and receipts.

Faster Approval and Payment Processing

With AP automation, approval, and payment processes become faster and more efficient. Electronic workflows send invoices to the right people for review and approval, reducing errors from manual routing.

Electronic methods like EFT (Electronic Funds Transfer) or virtual cards in AP and payment automation replace physical checks. This leads to shorter payment cycles, improved cash flow management, and increased supplier satisfaction.

Cost Savings and Increased Financial Control

Implementing AP automation saves costs. It lets organizations use resources better by cutting manual labor. Automation also allows for early payment discounts and better payment terms. This leads to further savings and better management of working capital.

Enhanced Data Analytics and Reporting

AP automation generates valuable data that is used for analytics and reporting. The system captures and organizes invoice data, providing insights into spending patterns, supplier performance, and potential cost-saving opportunities.

This data-driven approach helps to make informed decision-making, helps get a good deal in contracts with vendors, and supports strategic financial planning.

Read Also Inventory Forecasting: Best Practices and Strategies for Effective Planning

How Does AP Automation Work?

AP automation uses linked steps that use technology and software to simplify and improve the accounts payable process. Here is an overview of how the best AP automation software works:

Invoice Capture

The process starts by capturing invoices. Physical invoices are scanned and turned into digital form, or electronic invoices are imported directly into the system.

Data Validation And Verification

The extracted data is validated and verified against existing records in the system. Automated validation checks ensure accuracy and completeness, such as matching the invoice data with purchase orders and receipts. Any Differences or errors are given for review and resolution.

Invoice Approval Workflow

The automation system approves the invoices once the data is proven. Electronic workflows are configured to send invoices to the appropriate individuals or departments based on pre-decided rules and guidelines.

Payment Processing

After approval, the automation system initiates the payment process. Depending on the setup, the system may automatically generate payment files or start electronic fund transfers (EFT) to vendors.

Virtual card solutions may also be used for secure and convenient payment processing. The system records payment details and updates the corresponding accounting records.

Reporting And Analytics

AP automation provides real-time visibility into accounts payable. Changing reporting and analytics functionalities allow organizations to:

- track key performance indicators (KPIs)

- observe invoice status

- evaluate spending patterns

- identify areas for cost savings

- process improvement.

Read Also Inventory Days on Hand: Calculation, Importance and Example

The ROI Of AP Automation

Return on Investment (ROI) can be helpful for organizations that implement this technology. Here are several key factors that contribute to the ROI of AP automation:

1. Cost Savings

AP automation reduces the need for manual labor and paper-based processes, resulting in cost savings. Automation reduces

- Manual data entry

- Reduces errors

- Helps in workflows

2. Improved Speed

AP automation improves Speed by automating manual tasks like data entry and invoice matching.

3. Enhanced Accuracy and Compliance

Payment Differences can occur, as manual processes have mistakes and agreement issues. AP automation uses unique technology like Optical Character Recognition technology to capture invoice data.

4. Reduced Invoice Processing Costs

With AP automation, organizations can reduce invoice processing costs. By minimizing paper-based invoices, physical storage requirements are minimized.

Read Also Raw Materials Inventory: Definition, Formula, and Turnover

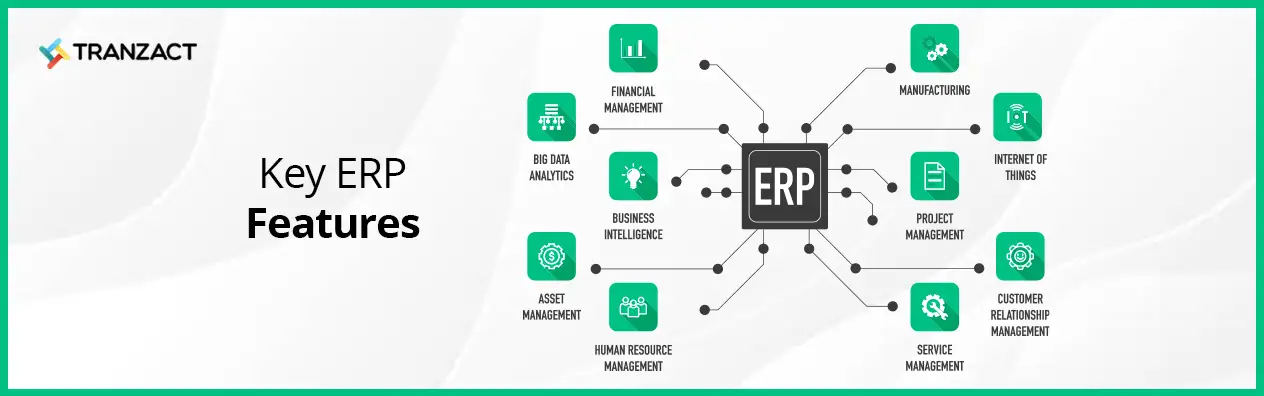

Automate AP Without Reworking Your ERP

AP automation, like the "office automation certificate in AP," can be added to your ERP(Enterprise Resource Planning) system without any modifications.

By integrating with your ERP system, AP automation simplifies the following:

- Invoice processing

- Approval workflows

- Payment processing.

This allows benefits of AP automation while maintaining the stability and knowledge of their existing ERP system.

Transform Your AP Process. Achieve Speed And Savings Today!

AP automation software makes paying bills and managing money easier. It takes away the need to do things by hand, which means fewer mistakes. It uses special tools to capture data, match invoices, and get approvals automatically. It also helps pay electronically, making the whole process faster and keeping good relationships with the people you owe money to.

Integrate TranZact with your ERP system easily to simplify workflows. Enjoy benefits like accurate invoice processing, better cash flow, and helpful analytics. Use AP automation for better decision-making

Schedule a demo now and unlock the potential of TranZact.

FAQs On AP Automation

1. Can AP automation be implemented without disrupting our current ERP system?

Yes. AP automation solutions are designed to integrate with your current ERP system, minimizing potential disruptions.

2. Will AP automation require significant changes to our current AP processes?

Yes. AP automation can be made to match your current AP processes, minimizing the need for significant process changes.

3. How long does it take to implement AP automation?

The implementation timeline for AP automation can vary depending on the difficulty of your organization's processes, but it can typically be completed within a few weeks to a few months.

4. Is it necessary to have a large IT team to implement AP automation?

No. AP automation providers typically handle the implementation and ongoing support, reducing the need for a large in-house IT team.

5. Can AP automation accommodate different invoice formats and types?

Yes, AP automation solutions are designed to handle various invoice formats and types, including paper, electronic, and PDF invoices.

6. What are the potential cost savings associated with AP automation?

AP automation can:

- Save costs by reducing manual labor

- Minimize errors

- Optimize payment termsTake advantage of early payment discounts.