The most recent update to e-invoice in GST is that starting 1st August 2023, all registered taxpayers with an aggregate turnover of 'Rs. 5 crores or more' must generate e-invoices. The centre has reduced the GST e-invoice turnover limit to 5 crores from 10 crores, making it compulsory for smaller businesses to shift to e-invoices for all business transactions.

The objective that the Indian central government sought to accomplish by implementing the GST Act in 2017 was to reduce the burden on taxpayers and enhance system transparency. With this in mind, the government has made numerous further attempts to improve the system by adopting and implementing new features such as the E-Way Bill System, E-Invoice in GST Act, and so on.

The recent update breaks the assumption that all these requirements of e-invoices in GST are mostly for big companies having a turnover of Rs. 50 crores and above.

With this blog, we aim to help you understand everything there is to know about e-invoices in GST. So, let's begin.

What Is E-Invoicing Under GST?

E-Invoice also known as E-invoicing is a system in which all Business-to-Business (B2B) invoices and other documents are electronically uploaded and authenticated on the government's GST Invoice Registration Portal (IRP). And after the successful verification of the invoice, a unique Invoice Reference Number (IRN) is generated by the IRP portal. Additionally, it is mandatory for the applicable businesses to generate a QR code for the e-invoice.

Further, together with the IRN and QR code, a digitally signed invoice would be available for the supplier. This is issued to the product's recipient, and is known as the e-invoice or electronic invoice.

E-Invoicing eliminates the need to create new invoices on government portals; instead, it involves uploading GST invoices issued by businesses to the IRP Portal through designated software.

Who Must Generate an E-Invoice?

The e-invoice functionality was earlier applicable to all registered businesses which had an aggregate turnover of Rs. 500 crores, since October 1, 2020. But as the new notifications were issued, the turnover limit started decreasing in phases from Rs. 100 crore to Rs. 10 crore and now to Rs. 5 crores.

So as per the new notification no. 10/2023-Central Tax dated May 10, 2023, all businesses from August 1, 2023, with an aggregate turnover of Rs. 5 crores and more, will be required to generate and issue e-invoices to their customers. And in that, the e-invoice bracket will include documents like tax invoices, credit notes and debit notes.

If a taxpayer's e-invoice limit or turnover exceeds the stipulated limit in any fiscal year from 2017-18 to 2021-22, they must comply with e-invoicing in FY 2022-23 and onwards. Furthermore, the aggregate turnover will include the turnover of all GSTINs in India under a single PAN.

E-Invoice Turnover Limit Criteria

| Phase | Applicable to taxpayers with an aggregate turnover exceeding | Applicable Date | Notification Number |

|---|---|---|---|

| I | Rs 500 crore | 01.10.2020 | 61/2020 - Central Tax and 70/2020 - Central Tax |

| II | Rs 100 crore | 01.01.2021 | 88/2020 - Central Tax |

| III | Rs 50 crore | 01.04.2021 | 5/2021 - Central Tax |

| IV | Rs 20 crore | 01.04.2022 | 1/2022 - Central Tax |

| V | Rs 10 crore | 01.10.2022 | 17/2022 - Central Tax |

| VI | Rs 5 crore | 01.08.2023 | 10/2023 - Central Tax |

Consider the aggregate turnover of XYZ Ltd for different financial years:

FY 2017-18: Rs 15 crore

FY 2018-19: Rs 17 crore

FY 2019-20: Rs 24 crore

FY 2020-21: Rs 19 crore

FY 2021-22: Rs 18 crore

Also, let's take the aggregate turnover of ABC Ltd:

FY 2019-20: Rs 4 crore

FY 2020-21: Rs 7 crore

FY 2021-22: Rs 11 crore

Since XYZ Ltd crossed the turnover limit of Rs 20 crore in FY 2019-20, it is required to generate e-invoices from 01.04.2022, irrespective of the current year's turnover.

ABC Ltd needs to comply with e-invoicing from 1st October 2022 as its previous year's annual turnover exceeded Rs 10 crore.

Now, let's consider the aggregate turnover of JKL Ltd:

FY 2020-21: Rs 2 crore

FY 2021-22: Rs 3 crore

FY 2022-23: Rs 6 crore

On the other hand, JKL needs to comply with e-invoicing from 1st August 2023 as its previous year's annual turnover exceeded Rs 5 crore.

Who All Are Exempted From E-Invoicing?

Nevertheless, regardless of turnover, the following registered persons are not currently eligible for e-invoicing, as stated in CBIC Notification No.10/2023 - Central Tax, as amended:

| Businesses | For these documents | For these transactions |

|---|---|---|

| An insurance, banking, or financial institution, including an NBFC | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| Goods Transport Agency (GTA) | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit Note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| All the registered businesses or persons supplying passenger transportation services | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit Note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| All the registered businesses or persons supplying services by way of admission to the exhibition of cinematographic films in multiplex services | Documents like the Bill of Supply, Bill of Entry, Commercial Credit note or Debit note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| SEZ unit (excluded via CBIC Notification No. 61/2020 - Central Tax) | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| All the Government departments and Local authorities (excluded via CBIC Notification No. 23/2021 - Central Tax) | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

| All registered persons as per terms of Rule 14 of CGST Rules (OIDAR) | Documents like the Bill of Supply, Bill of Entry, Commercial Credit Note or Debit note, Financial Notes Delivery Challan, and ISD invoices. | Any Business-to-Consumer (B2C) sales, nil-rated or non-taxable or exempt Business-to-Business (B2B) sales, exempt Business-to-Government (B2G) sales, imports, high seas sales, bonded warehouse sales, Free Trade & Warehousing Zones (FTWZ), and supplies made under reverse charge covered by Section 9(4) of the CGST Act. |

How Was the System Before E-Invoicing?

Before e-invoicing was implemented in the year 2020, businesses used to generate invoices and any other transactional documents with manual accounting and invoicing tools. During return filing, businesses either opted to enter all these details manually directly on the GST portal or choose the offline method of uploading a JSON file for the return. And a similar process was followed for e-way bills and all the returns verification like for GSTR-1 and GSTR-2A.

So to remove this difficulty of manually entering all details and conducting the data reconciliation process, the GST Council introduced the electronic invoicing system.

How to Generate an E-Invoice?

The steps required for generating an e-invoice are as follows:

Generating the invoice

With their usual invoicing or ERP software solutions, taxpayers will create invoices. While generating the invoice, they should take care of all the mandatory requirements as stated in the GST Act and E-Invoice.

Creating a unique Invoice Reference Number (IRN)

Based on the information provided by the seller, such as GSTIN, document type, document number, and fiscal year, the IRP portal will generate a hash parameter. After determining that no duplicate invoices exist in the Central Registry, the e-invoice portal will add its signature and a QR code to the invoice's JSON data.

Based on the information provided by the seller, such as GSTIN, document type, document number, and fiscal year, the IRP will generate a hash parameter. After determining that no duplicate invoices exist in the Central Registry, the IRP will add its signature and a QR code to the invoice's JSON data. The IRP portal's hash will be the concerned e-invoice-related, Invoice Reference Number (IRN).

Introducing the GST E-Invoice in the Business Transaction System

The taxpayer may continue to introduce and transmit this invoice to the recipient while printing it as it is currently done with a logo. Meanwhile, IRP will submit the authenticated payload to the GST portal in order to process GST returns. Details will also be sent to the e-way bill site, if applicable. For the concerned tax period, the seller's GSTR-1 is filled out automatically. This allows the determination of the tax liability.

Benefits of E-Invoicing

Now that we have understood what -invoicing is, let's take a look at the benefits they offer:

- The first thing it solves is that it saves a lot of time for the taxpayer not to do repetitive tasks. With the electronic invoicing system in place, details can automatically get pre-populated in the GSTR-1 return and in part-A of e-way bills.

- It reduces data reconciliation problems, as the IRP system shares all the e-invoice data with the GST and e-way bill portals.

- E-invoicing allows for real-time tracking of invoices prepared by a supplier, which is very helpful for tax authorities.

- It allows for faster availability of Input Tax Credit (ITC) and removes substantial risk in its verification part. This is because the data input in the e-invoice prepared alone will be shared with both the recipient and GSTR-1 return. Further, it will get auto-populated in the GSTR-2A return as well.

- By enabling interoperability and lowering data entry errors, e-invoices generated by one piece of software can be read by another.

- Since, the information tax authorities need is readily available at the transaction level, they are less likely to carry out audits or surveys. It will also assist officials in combating fake invoicing methods.

- SMEs benefit with the availability of e-invoicing by removing some repetitive business procedures from their plate. SME entrepreneurs have a tendency to bounce from one activity to the next. And electronic invoicing allows them to quickly manage invoicing, payables and receivables. As a result, they can now focus on numerous other vital business functions.

How Can E-Invoices Curb Tax Evasion?

As per GST invoicing rules, since, all the e-invoices need to be generated first on the IRP portal, it provides a real-time update to the tax authorities even before the recipient has the invoice.

Further, it does not easily allow the facility to edit or cancel the invoice. This eliminates the possibility of fake invoicing and erroneous input tax credit as chances of invoice manipulation are removed. Further, all this information is provided in the e-way bill too, forming a closed loop.

Therefore, through all these benefits, e-invoices remove the possibility of tax leakages in the end-to-end business transaction process.

Why Was E-Invoicing Introduced?

In the 37th meeting of the GST Council, they introduced the concept of e-invoice for GST taxpayers. Initially, it was only applicable to taxpayers with a large annual turnover of Rs. 500 crores, but it is currently being implemented for SME businesses with an annual turnover of Rs. 5 crores as well.

So, the key motivation behind the introduction of this new functionality was to first establish uniformity across all invoices generated by businesses. It was done because there are numerous accounting and invoicing software in the market today that produce unique invoice formats. As a result, even though they contained similar information, they were difficult to manage on the GST portal.

The Council proposed the unique solution of electronic invoicing to overcome this obstacle. Furthermore, it will address the significant problem of tax evasion and fraud caused by the use of fake invoices. These invoices must first be validated by the GST portal before being issued to the supplier. In order to cancel an invoice, an intimation must be sent to the IRP site within 24 hours, after which it will be validated.

What Are the Mandatory Fields of an E-Invoice?

All e-invoices follow the requirements of the GST Act, 2017 related to invoicing activities. In the following table, all the 30 mandatory fields required in an e-invoice format are mentioned. These fields are essential to ensure effective e-invoice applicability.

| Name of the Field | Description |

|---|---|

| Document Type Code | The document code specific to the type of document must be added here. |

| Supplier Legal Name | Name of the supplier as per the PAN card details. |

| Supplier GSTIN | Supplier's GSTIN for e-invoice. |

| Supplier Address | Full address of the supplier including building no., flat number, etc. |

| Supplier Place | Details including, the city, town, and village of the supplier must be specified here. |

| Supplier State Code | The state must be selected. |

| Supplier Pincode | The supplier's address has a six-digit pin code. |

| Document Number | A unique invoice number relevant to the business, that is also sequential in order, for easy identification. |

| Preceding Invoice Reference and Date | The original invoice details which got amended and in lieu of this a further document is issued like a credit or debit note. |

| Document Date | Document Date is the date when the invoice was issued. |

| Recipient Legal Name | The buyer's legal name is added, according to his PAN card. |

| Recipient's GSTIN | The buyer's GSTIN needs to be specified. |

| Recipient's Address | Here, the buyer's address must be added, in detail. |

| Recipient's State Code | Place of supply needs to be specified. |

| Place of Supply State Code | The state of the recipient needs to get selected. |

| Pincode | The recipient's location has to be selected. |

| Recipient Place | Details including, the city, town, and village of the recipient must be specified here. |

| Invoice Reference Number or IRN | During registration, the supplier leaves the field empty. After which, GSTIN creates a unique number when the e-invoice is uploaded on the GSTN portal. As the e-invoice is accepted, acknowledgment is sent. It is mandatory for the IRN to be displayed, before the use of an e-invoice. |

| Shipping To GSTIN | This relates to the GSTIN of the person, to whom the item is being delivered. |

| Shipping To State, Pincode and State Code | Here, shipping details for delivery of the goods and services must be added. |

| Dispatch From Name, Address, Place and Pincode | Dispatching entity name along with the town/city/village specifics. |

| Is Service | If the supply of service has to be specified. |

| Supply Type Code | The type of supply and its responding code are specified. It can be supplied to SEZ, B2B, etc. |

| Item Description | The item's description. |

| HSN Code | The particular code for the services or goods. |

| Item Price | The GST exclusive unit price before the item price discount is deducted. It would result in a positive value. |

| Assessable Value | The item's price excludes GST after the item price discount has been subtracted. |

| GST Rate | The rate of the particular item, for which the invoice has been generated. |

| CGST Value, IGST Value, and SGST Value, separately | It is mandatory for every item to include IGST, SGST, and CGST. |

| Total Invoice Value | The total value including GST. |

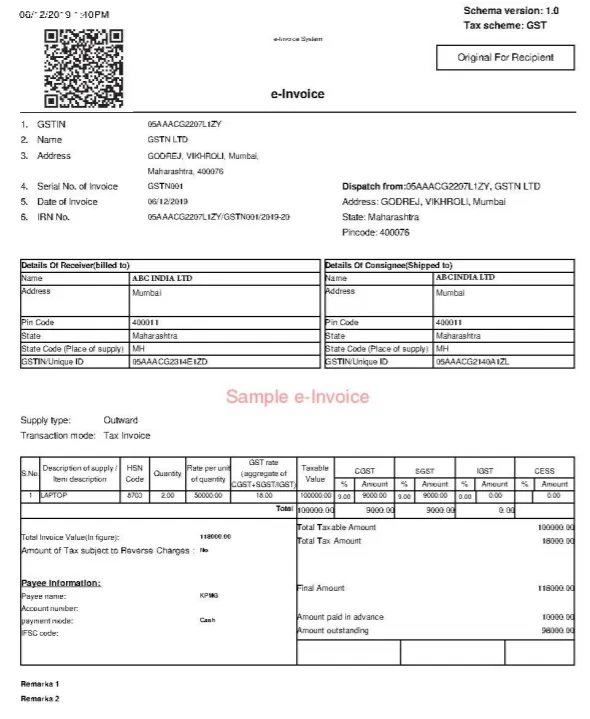

Format of Sample E-Invoice.

This is one sample of an e-invoice format issued by the GST authorities:

With TranZact, Accelerate Business Digitization and Fulfill E-Invoice Requirements Seamlessly

While reading this article, you may have realized that e-invoicing is significantly assisting businesses in taking their first step toward digitalization. It is highly recommended that you leverage e-invoicing and move forward with digitizing your entire organization. On your path towards digitization, TranZact is the tool that will certainly be useful.

TranZact is a platform and tool for seamless digital transformation, that helps SMEs digitize all aspects of their business processes, from customer inquiries to dispatch. It also assists businesses with all of their invoicing and e-invoicing requirements while adhering to all GST guidelines.

FAQs on E-Invoice in GST

1. What is the penalty if an e-invoice is not generated?

The penalty for not issuing an e-invoice is 100% of the tax due or Rs. 10,000, whichever is higher. Further, if an incorrect invoicing is done the penalty for this error is Rs. 25,000.

2. How to cancel an e-invoice in the GST portal?

If you want to cancel an e-invoice, you must do it manually through the GST portal. This must be completed prior to filing returns. When you cancel, the invoice number cannot be reused; a new one must be generated or the IRP will reject it.

3. How to amend an e-invoice in the GST portal?

The e-invoice cannot be amended or corrected if there is a mistake, incorrect, or wrong entry. The only choice is to delete that invoice/IRN, upload a new invoice (with a new number, of course), and create a new IRN.

4. How to verify an e-invoice in the GST portal?

To verify an e-invoice in the GST portal, log in to the portal and navigate to the 'E-Invoice' section. Enter the invoice details, such as the document type, supplier GSTIN, document number, and financial year, and click on the 'Verify' button to validate the e-invoice.

5. Which are the types of businesses to whom e-invoice will be applicable?

E-invoicing will be applicable to businesses that have a specified annual turnover threshold. In India, currently, e-invoice is applicable to businesses with a turnover of Rs. 5 crores or more.

6. What types of businesses are to be reported to the GST system?

Business owners and dealers registered under the GST system are obligated to submit GST returns based on the nature of their business or transactions. In many states, businesses are required to register for GST if their annual turnover exceeds Rs. 40 lakhs (for goods) or Rs. 20 lakhs (for services).

7. What are the modes of generating e-invoice?

In India, e-invoices can be generated through ERP systems, which allow businesses to integrate their accounting software with the GST portal for direct e-invoice generation. Alternatively, businesses can also use authorized GST Suvidha Providers (GSP) portals for generating e-invoices.

8. Is e-way bill required for e-invoice?

An e-invoice is generated before an e-way bill in the invoicing process, therefore it can be generated without an e-way bill. However, an e-way bill is still mandatory for inter-state and intra-state movement of goods.