As businesses continue to operate in the digital age, the creation of important documents such as invoices, purchase and sales orders, and quotations has become a daily occurrence. However, in cases where discrepancies arise, such as incorrect billing or damaged goods, the need for alterations in the accounting books and transactional documents like invoices is crucial. This is where debit notes and credit notes come in handy.

Take, for instance, the case of Mr. B, who mistakenly sold damaged goods worth Rs. 10,000 on a bill of Rs. 50,000. Instead of going through the cumbersome process of modifying invoices, he could have easily issued a credit note to the receiver, which is a more efficient and less time-consuming solution.

With the introduction of GST rules, debit and credit notes have become more important than ever, and it's essential for businesses to understand this process in detail and adopt automated tools that facilitate the creation of debit and credit notes.

In this article, we'll explore the basics of debit and credit notes, the key differences between the two, and other important factors to consider. So, if you're an Indian business owner or accountant, read on to discover how debit and credit notes can simplify your accounting process and help you avoid costly mistakes.

What Is A Debit Note?

A debit note is an instrument issued by the seller to the buyer to mark the transaction in the absence of an invoice, or to rectify the details of an already generated invoice to balance the books.

Alternatively, a buyer can issue a debit note to indicate a debit balance on the seller's account wherein damaged, and bad-quality products are received.

Commonly used in B2B transactions, a debit note, whenever issued, creates an additional tax liability; however, a supplementary invoice (debit note) will be treated as equivalent to a tax invoice in respect of payments.

Moreover, it is mandatory for the parties involved in such a transaction to retain the records of the debit note or supplementary invoice transaction till expiry period of 72 months, from the date of filing of annual records related to such transaction.

What Is A Credit Note?

A credit note is an instrument issued by the seller to the buyer to write off a debt obligation for an invoice, either partially or wholly.

A credit note also acts as a declaration wherein, the issuer states that the account of the other party involved has been credited to the sender's book. Thus, the debited amount has been either reduced or written off entirely.

Moreover, as mandated by the GST norms, the records of a transaction completed via a credit note have to be retained till the expiry of 72 months from the date of filing the annual return related to the transaction.

Difference Between a Debit Note and a Credit Note

Both these instruments are primarily leveraged by businesses to rectify errors made during the generation of invoices, or to balance the account in other possible scenarios, such as returns.

Both terms may be confusing in some cases, so let's look at them individually and see their major differences:

| Basis of distinction | Debit Note | Credit Note |

|---|---|---|

| Meaning | An instrument used to reflect a debit on the account of another party thus involved in the transaction. The same may be issued, when the buyer receives a lot of damaged goods and wants to return the same because of quality concerns. | A credit note is an instrument used to reflect credit on account of the other party thus involved in the transaction. The same may be issued by the seller to indicate the acceptance of a purchase return and to write off the debt obligation of the other party either partially or wholly. |

| Impact | Issuance of a debit note would reflect a reduction in the account receivable. | Contrary to this, issuing a credit note reflects a reduction in accounts payable. |

| Exchanged for | A debit note is exchanged for a credit note. | A credit note is exchanged for a debit note. |

| Reflects | On issuance of a debit note, it would reflect a positive amount. | On issuance of a credit note, it would reflect a negative amount. |

| Tax Liability | In most cases, whenever a debit note is issued, it further increases the tax liabilities. | In the case of issuance of a credit note, you can reduce the output tax liability, if the return mentions transaction and other details correctly, in line with other documents. |

| Legal Perspective | A debit note is an instrument via which you can legally enhance the value of the goods sold or services rendered in the original tax invoice. It allows the supplier to pay the tax he is liable for without a complex process. | On the other hand, a credit note comes in handy when a supplier wishes to reduce his part of the tax liabilities by legally amending and revising the original tax invoices. |

When are Debit Note And Credit Note Issued?

Having understood the basics of credit and debit notes, let's look at the scenarios when one can issue the same:

When is a credit note issued?

As per the GST norms, you can issue a credit note in the following situations:

- The value of goods declared by the supplier, is way more than the actual value of the delivered goods.

- The tax amount levied on the goods is unusual, and not what is usually levied as per the GST norms on such categories of goods.

- The quantity delivered to the buyer was not as per the agreement.

- There are quality issues in the lot received by the party.

When is a debit note issued?

As per the GST norms, a debit note is issued in the following situations:

- The value of the supplied goods or services is way less than their actual value.

- The tax levied on goods delivery is below the usually charged amount on such categories.

- The buyer has received a quantity that is more than the agreement.

What Are The Details To Be Included In Debit Note And Credit Note?

There are several details to be mandatorily included in a debit note and credit note format. Following is the list you can follow:

- You must mention the supplier's name, address, and GSTIN number.

- The nature of the document, i.e., whether it is a credit or a debit note, should be mentioned.

- A serial number has to be given to the issued instrument, which shall not exceed 16 characters and should be unique to the financial year in which it has been generated.

- The instrument must also have the date of issuance of the document along with the receiver's name, address, and GSTIN number.

- Details regarding the receiver's address, name, address of the consignment delivery, state name, and code to be added.

- The value of the consignment shall be disclosed clearly, along with the details regarding the tax levied.

- Signature of the person thus issuing the instrument.

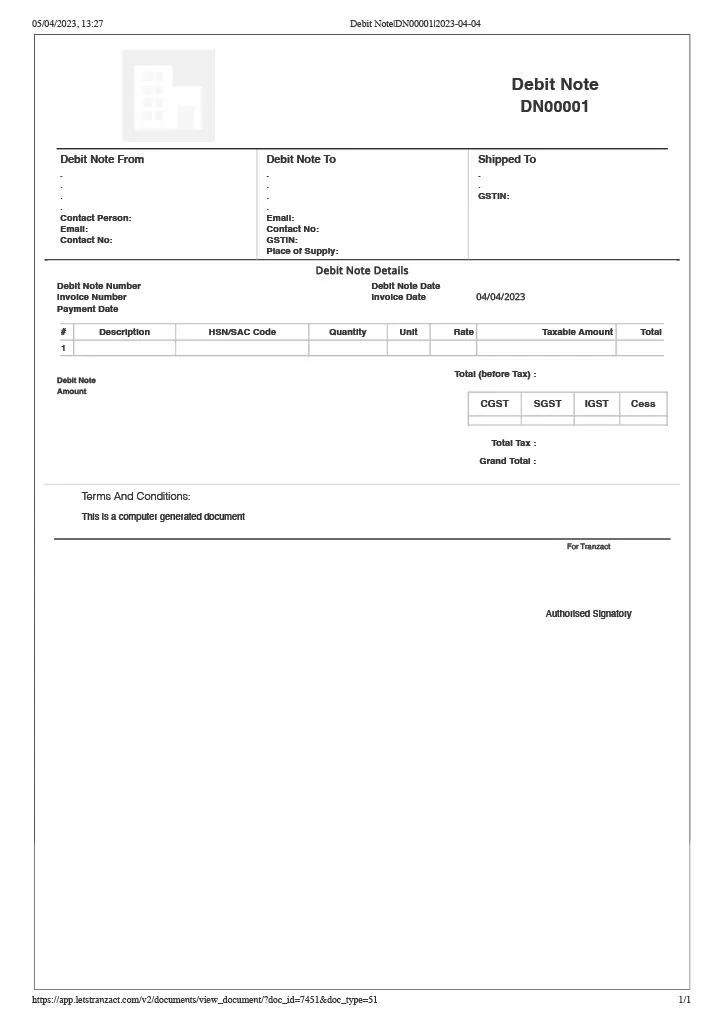

Debit Note Format Under GST

One must keep in mind a few things before generating a debit note to ensure due compliance during legal and financial audits; the following is a format you can follow:

- Mention clearly, the name and nature of the instrument

- The supplier's name, address, and GSTIN

- A serial number, less than 16 characters, specific to the financial year

- The date of issuance

- The serial number and date of the invoice for which you have issued the debit note

- Name, address, and GSTIN (registered buyer), or name, address, address of delivery with state and pincode (non-GST registered buyers)

- The debit note must indicate the price of the consignment along with the tax and other liabilities

- Finally, the issuing person must sign the instrument, or if the person is unavailable, it must be signed by the person in charge, in his place (digital signatures are also accepted and considered legal now)

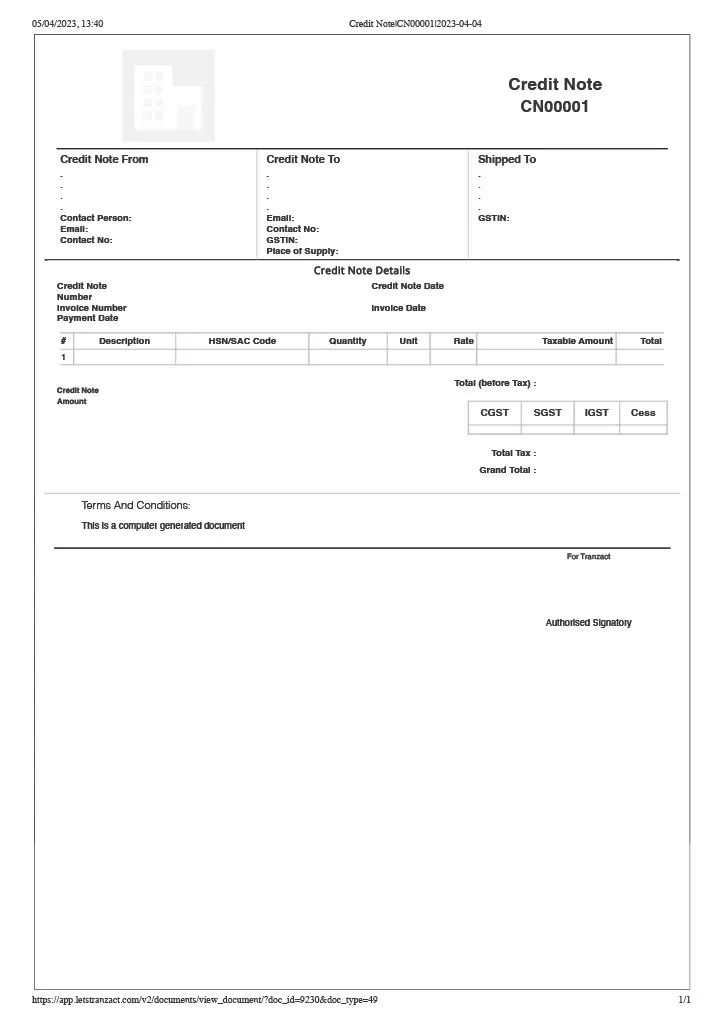

Credit Note Format Under GST

The credit note and debit note format is similar in many ways. Let's have a look:

- It must necessarily entail the name and nature of the document

- The supplier's name, address, and GSTIN are also mandatory

- A serial number must be given to the note, specific to the financial year, which shall not exceed 16 characters

- The issuance date must be present

- Serial number and the date of tax invoice for which the credit note is being issued

- Name and address of the buyer plus the delivery address with state and pin code for an unregistered buyer

- Finally, it must mention the consignment's value and the tax levied

- The signature of the issuing person is also required, mandatorily, or it won't be accepted as evidence for legal purposes.

Automate Debit And Credit Notes With An Expert Tool

Credit and debit notes are two instruments that are essential for any business, considering how to streamline accounting and bookkeeping transactions and align them with everyday business transactions.

Regular management of debit and credit notes can be a time-intensive task for all the departments involved in a SME manufacturing business. Why not automate the creation of such documents with a cloud-based business automation tool like TranZact. TranZact digitizes all core functions for an SME including sales, purchase, inventory and production.

With TranZact you can seamlessly create a debit note and credit note, in addition to many other important documents such as GST-compliant invoices, purchase and sales orders, quotations, challan and more. Users can also share these documents easily over WhatsApp and Emails for increased convenience.

In addition to expert documentation, TranZact also offers business intelligence and reporting functions. It provides a free sign up with all base features free forever. Business owners can sign up, explore the tool and upgrade only when they are fully convinced of how valuable TranZact is for their business!

FAQs on Debit Note vs Credit Note

1. Who prepares credit note?

A credit note is issued by the seller, which reflects a credit applied to the other party's account.

2. Who prepares a debit note?

A debit note is used in multiple scenarios by the seller to mark a transaction that has not been cashed yet. Alternatively, it can be issued by the buyer in cases where damaged goods are received.

3. What is the difference between a refund and a credit note?

Refunds and credit notes are two common ways for businesses to handle returns and cancellations, but they work differently. A refund is a payment returned to the customer's account, while a credit note is a document of proof stating its monetary value and could be used for future purchases.

4. How Does a Credit Memo Affect Accounts Receivable?

A credit memo is a document that reduces the amount owed by a customer. It can be issued for various reasons, such as returns, discounts, or errors. When a credit memo is issued, it affects the customer's account balance, reducing the amount they owe. This, in turn, affects the accounts receivable balance, which represents the total amount owed to a business by its customers