The GSTR-2A Reconciliation process is one of the most important aspects of GST. GSTR-2A is a mechanized document that details the purchases and suppliers' details of the buyer and seller.

It is important so that taxpayers avoid tax accumulation, organize it well, and avoid paying taxes multiple times.

The GSTR-2A reconciliation process provides precise information and the amount a taxpayer is liable to pay per Input Tax Credit (ITC) guidelines.

Data reconciliation enhances data analysis, investing in funds, and sorting and claiming of Input Tax Credits.

Here is a rundown of GSTR-2A Reconciliation and its various aspects.

Define GSTR-2A Reconciliation

GSTR-2A is an electronic document that provides real-time visibility into buyer expenditures and outbound supplies. Inward supplies and ITC information are automatically filled out on GSTR-5 and GSTR-6. GSTR 2A auto reconciliation is an automatic process playing an important role for taxpayers.

Supplier invoices are shown in read-only Form - GSTR 2A and are dynamically updated as uploaded.

Determining ITC eligibility monthly or quarterly via Form - GSTR-3B returns depends on submitting a declaration when suppliers update their expense invoices for products and services.

As GSTR-2B is automatically created, ensure that GSTR-3B remains consistent and is updated monthly.

GSTR-2A reconciliation helps firms identify inconsistencies by comparing invoices from GSTR-2A and those from their records.

Errors can occur due to the inability of the buyer to record the purchase in the accounts, errors in sales returns by the seller, lack of proper records, etc.

ITC reconciliation is carried out once or twice a month to guarantee proper and timely payment of invoices. It is vital to ensure that GSTR- 2A and GSTR - 3B align with each other.

GSTR 2A reconciliation primarily tackles two mechanisms-

- Handling the purchase records

- Handling GSTR - 2A, GSTR- 5, GSTR- 6, and GSTR 1 data

If the supplier or business fails to produce sale invoices to the recipient, it does not appear in GSTR - 1. It automatically implies that the transaction is not displayed in GSTR- 2A. It affects the ability of the liable recipient to claim an Input Tax Credit.

Input Tax Credit, TDS Credit, and TCS Credit data based on seller returns (GSTR-1, GSTR-7, GSTR-5, GSTR-6, and GSTR-8) are shown in the accounts system.

For correct reporting, matching up the Input Tax Credits claimed in GSTR-3B with those in GSTR-2A, which reflects invoice data, is essential.

What is the Need for GSTR-2A Reconciliation Under GST?

There are numerous reasons why GSTR-2A reconciliation with GSTR-3B is important under GST.

ITC is an essential part of GST, and the Input Tax Regime can eliminate the cascading effect of taxes and ensure that businesses and companies comply with the GST regulations.

Businesses and companies can exhaust their resources and funds by paying taxes multiple times and imbalance the monetary resources leading to losses in case of a proper taxation system.

The following include the importance and the need for GSTR-2A Reconciliation under GST -

- The new GST return permits payers to assert an ITC for transactions in GSTR-2A or supplier records. Still, the reconciliation of accounts requires specific declarations. It tracks ITC and makes sure that no ITC untracked or repeated.

- It ensures that the vendors or sellers abide by the GST liabilities. The authorities consider that taxpayers with mismatched records are issued notices, and proper steps are taken into account.

- Routine GSTR-2A reconciliation aids in finding and uploading any incomplete invoices from suppliers.

- It ensures that the buyers do not miss any recording from the purchase invoice.

- It ensures that no purchase record or invoice has been recorded more than once.

- Reconciliation corrects incorrect invoice values, enabling corrective action for better data accuracy.

- ITC reconciliation is essential for businesses because it ensures that the GST code is strictly enforced by stimulating integrity and penalizing theft or filing false returns.

- If invoices are available in GSTR-2A, only ITC can be reclaimed under the present GST framework.

- Reconciliation allows the government to track the defaulters, track the commonly conducted errors, and record the number of times a mistake is created.

- The GSTR 2A/GSTR 2B reconciliation hinders ITC claims on purchases not reflected in GSTR-2A or GSTR-2B. Substantial claims, including potential fees and penalties, may be imposed. Reconciliation aids with recognizing and adhering to erroneous invoices with vendors.

- The government uses automated return creation and invoicing verification to transfer ITC between states efficiently.

- The framework utilized by the government is automated and autonomous. It enables investors, vendors, and company owners to provide credible evidence of interactions to be eligible for ITC.

Steps for GSTR-2A Reconciliation

To request GSTR-2A reconciliation, here are the important steps that must be followed -

1. Download the GSTR- 2A Form

- To download the GSTR 2A form, head to the official GST Portal. You can choose to register or log in to your existing account.

- Once logged in, select "Return Dashboard" and opt for the desirable Return period, i.e., Monthly, Quarterly, or Semi-Annually.

- In the "Returns section," click the "Auto-Drafted GSTR 2A" form option and click on "Downloads."

- You can download the file in Excel or other formats your PC or mobile devices allow.

- After 15 to 20 minutes, you may receive the downloading link. Download the file.

- Once downloaded in the necessary formats, the businesses can access the invoice details and other credentials.

Here are the circumstances or conditions displayed on the GST Portal regarding the invoice details -

- Fully Matched

It implies that the GSTR- 2A records match with GSTR- 2B records.

- Partially Matched

If the records in the company’s accounts book do not match completely with the records of the invoice in the GST portal.

- Available Only in Books

It occurs when the supplier does not upload the invoices properly.

- Available Only in Portal

This record occurs when the supplier uploads the records for expenses and all the transactions that occurred, but the data is not recorded in the books.

- Invoice Number Mismatch

These details specify that the invoice number does not match the downloaded invoice information.

- GSTIN Mismatch

It displays the invoice-related information when the GSTIN number does not match the downloaded invoice information.

2. Reconcile GSTR- 2A form with the incurred purchases

- Recording the GSTR- 2A accounts and matching them with the ITC (Input Tax Credit) is important.

- Evaluate and recognize the reasons for the mismatch, take necessary action, and reconcile the ITC.

- Once the incurred purchases and expenses are tracked in the accounts, the taxpayers can file for GSTR- 3B.

3. Reconcile GSTR- 2A and GSTR- 3B and device necessary plans

- After GSTR- 2A and GSTR- 3B are filed, it is crucial to keep them in agreement.

- Match the already filled GSTR- 2A records with the input tax credit details regarding GSTR- 3B.

- Comprehend the reasons for mismatch and errors in the records for GSTR- 2A and GSTR- 3B records.

- Once you evaluate the necessary errors, it is important to reconcile the ITC records with each other. You can leverage GSTR-2A reconciliation software for this purpose.

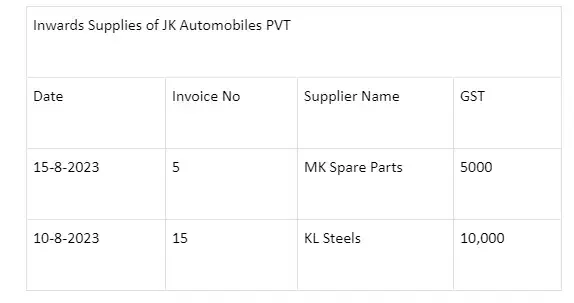

Example of GSTR 2A Reconciliation Tool -

KL Steels and MK Spare Parts will upload the invoices to the GST Portal and record the supplies provided to JK Automobiles.

JK Automobiles can check the details, changes, delivery date, etc., through GSTR 2A once they download it from the GST Portal or another trustable source.

JK Automobiles must match the records of their account books to the records on the Portal. This matching of invoices is referred to as GSTR-2A reconciliation.

GSTR-2A Reconciliation Tool

The GSTR-2A Reconciliation tool is important for businesses and companies. The government seeks to efficiently transfer ITC between states through invoice matching and automatic return production.

The system is automated and enhanced because business owners, suppliers, and traders must present verifiable proof of transactions to claim ITC.

The GSTR 2A can be downloaded in online and offline formats. You can also use automated GSTR-2A tools to update the data automatically.

While using a GST Reconciliation tool, here are the key things that you should keep in mind -

- Every ITC includes HSN codes. HSN numbers/ codes include 4/6/8 digits. They must be matched in every record. Any differences in the HSN codes can lead to losing Input Tax Credit.

- All businesses, including small businesses, must file for tax payments monthly and file taxes quarterly.

- Suppliers and sellers are required to file ITC forms and returns on time. Penalties can be imposed for non-compliance with GST guidelines.

GSTR-2A Reconciliation Made Easy With TranZact

Reconciliation is necessary to ensure businesses and companies retain maximum ITC and maximize their resources. It allows them to maintain well-organized records of high-volume data, ensuring clarity.

Reconciliation is the prime means to claim eligible and valid ITC. The manual process is time-consuming and tiring.

To combat that, you can try TranZact, which is the best GSTR-2A reconciliation software that is automated and will help businesses streamline their GST documentation process quickly.

FAQs on GSTR-2A Reconciliation

1. How do I reconcile my GSTR-2A?

To reconcile GSTR-2A, login into the GST portal. Enter the business credentials, download GSTR 2A, and select the return period. You may upload purchase records on the dashboard and match the GSTIN report to the GSTR 2A reports.

2. Is GSTR 2A reconciliation mandatory?

Yes, GSTR 2A is mandatory, and 100% invoice matching is critical for businesses to claim input tax credit with clarity.

3. What are GSTR 2A and 2B reconciliations?

GSTR 2A is an auto-generated read-only document that includes an in-depth analysis and view with a list of all the purchases made. In contrast, GSTR 2B is an overview of ITC applicable to taxpayers developed by the GST portal for a specific period.

4. What is the time limit for GST reconciliation?

The time limit for GST reconciliation is set for each financial year (March-April). And taxpayers must submit the same by 31st December of the next year.

5. How to do GSTR 2A reconciliation?

To perform GSTR-2A reconciliation, compare the details of purchases as per GSTR-2A (auto-populated form) with your records. Identify discrepancies, reconcile them, and take appropriate actions such as accepting, modifying, or rejecting the mismatches using the GSTR-2A reconciliation tool available on the GST portal.

6. What is the GSTR- 2A reconciliation format?

The GSTR-2A reconciliation format is a structured template used to reconcile the details of purchases as per the GSTR-2A form with the taxpayer's records. While there is no specific predefined format provided by the Goods and Services Tax Network (GSTN), the reconciliation process typically involves aligning the invoice-level details such as invoice number, supplier details, taxable value, and tax amounts between the GSTR-2A and the taxpayer's records.

7. What is GSTR-2A reconciliation?

GSTR-2A reconciliation compares and matches the details of purchases as per the GSTR-2A form (auto-populated) with the taxpayer's records to ensure accuracy and completeness.

8. What should I do if I find discrepancies during reconciliation?

If discrepancies are found during GSTR-2A reconciliation, further investigation is necessary. The taxpayer should communicate with the supplier to rectify any errors or mismatches. If the discrepancies persist, necessary actions such as modification or rejection can be taken while filing the GST returns.