When businesses are aware of what is LIFO or Last-In, First-Out method for inventory pricing and costing, they can decide if it's an inventory process that will suit their business needs effectively. A proper inventory management system with the right pricing tools is paramount for any growing business to upscale and perform efficiently.

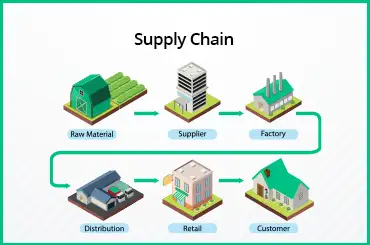

An excellent inventory and enterprise resource planning (ERP) software adoption would mean improved management of accounting, projects, supply chain, and day-to-day business activities. Let's find out more about LIFO as an inventory valuation method with examples and know the difference between FIFO and LIFO methods.

What Is LIFO?

Last-In, First-Out (LIFO) is a method used to record inventory where the most recent purchase items are sold first. Implying the newest products are cleared out first. It helps with maintaining records of lower-priced older items in the inventory. This method is mainly implemented by large inventory businesses to benefit from lower tax payments when the item costs rise and result in higher cashflow.

Example of LIFO

Below are a couple of examples of the LIFO method to analyze and understand its workings.

Example 1:

Purchase cost increases:

Karan owns a car dealership and purchases 5 cars for Rs. 1,00,000 each in January. Come March he buys 5 more cars for Rs. 2,00,000 each. He sold 7 Fiat cars during the first quarter of the year.

Under the LIFO method, the total sales are calculated on the price of cars purchased in March first, followed by January. Total Sales - 5 cars x Rs. 2,00,000 + 2 cars x Rs. 1,00,000 = Rs. 12,00,000.

Example 2:

Purchase cost decreases:

Karan owns a car dealership and purchases 5 cars for Rs. 2,00,000 each in January. Come March, he buys 5 more cars for Rs. 1,00,000 each. He sold 7 cars during the first quarter of the year.

Under the LIFO method, the total sales are calculated on the price of cars purchased in March. Total Sales = 5 cars x Rs. 1,00,000 + 2 cars x Rs. 2,00,000 = Rs. 9,00,000.

As evident from the examples, applying LIFO method generates more revenue when prices are increased resulting in a lower valuation of remaining inventory.

Why Would You Use LIFO?

The LIFO method is an excellent option for businesses that expect an increase in inventory cost. This method will assume that the most recent items purchased were sold first, which may lead to higher costs and lower profits. Lower profits in turn result in reduced tax payments. LIFO is ideal for businesses with extensive inventories, such as car dealerships, retailers, and gas and oil companies.

Benefits of LIFO

There are many benefits of using the LIFO method for inventory valuation, below are some of the main advantages :

Lower tax payment

As the cost of items increases for the business over time, the LIFO method helps save on tax payments considerably. It helps lower the profit margin by applying the recent or higher inventory costs to the items sold. The lower the profits, the fewer the taxes to be paid.

Updated financial records

Under the LIFO method, the most recent inventory cost is applied first to the price of items sold. It helps keep current financial records accurate and up to date. In turn, comparing current inventory costs with current sales is easy.

Better customer response

With the LIFO method, businesses can serve orders with the most recent inventory, resulting in a better customer experience. It leads to more customer retention and improves the business reputation.

Difference Between FIFO and LIFO Method

FIFO stands for First-in, First-out, where it assumes the oldest items in the inventory will be sold first and uses the lower cost numbers while determining the cost of the items sold. Similarly, LIFO stands for Last-in, First-out, where the assumption is the most recent items in the inventory will be sold first.

Usually, the LIFO method will yield lower closing inventory and higher cost of items sold, whereas the FIFO method results in higher closing inventory and lower price of items sold.

Predominantly the LIFO method is implemented among businesses with extensive inventories to take advantage of higher cashflows and lower tax payments when prices are increased. However, FIFO is the most commonly used method, since all accounting methods approve it and businesses prefer to sell older inventory items first before purchasing new stock.

What Are the Different Methods of Inventory Valuation?

Following are the most commonly used inventory valuation methods:

Last-in, First-out (LIFO)

This inventory valuation method assumes that newer items are sold first while older items remain in stock. It is mainly used during price inflation to save on tax payments.

First-in, First-out (FIFO)

In this method, the first item in inventory purchased is the first to be sold. The rest of the items in inventory are matched to the most recently purchased items.

Highest-in, First-out (HIFO)

In this method, the highest-cost items are the first to be taken out of stock. This in turn realizes the highest cost of the items sold, helping businesses significantly decrease their taxable income.

Weighted Average Cost

According to this method, a weighted average is used to determine the amount charged to the cost of items sold and inventory. The weighted average cost method divides the price of items available for sale by the number of available items.

Automating Inventory Costing Can Help Your Business

Implementing the LIFO method of inventory valuation can save taxes and create an up-to-date financial record for large inventory businesses. However, depending on the unique business, following a better inventory management system would help grow the organization and function efficiently.

Try TranZact's automated software for inventory management that helps you to automate inventory costing and gain increased inventory control for higher productivity!

FAQs on LIFO Method

1. What is LIFO inventory method?

LIFO which is short for 'Last-in, First-out' is a method of inventory record-keeping where the newest items are prioritized to be sold or consumed first. This directly affects the cost of goods sold (COGS) which is then calculated based on the cost of the most recently purchased or produced inventory, rather than the cost of the oldest inventory.

2. What is inventory valuation?

Inventory valuation is an accounting process used by businesses to determine the current value of inventory stock while preparing financial records.

3. When to use LIFO?

The LIFO method is implemented when the prices are rising, to help better match business revenue to the latest costs.

4. Is LIFO illegal?

As per the revised Indian Accounting Standard (Ind AS) 2, the LIFO method is not permitted. US Generally Accepted Accounting Principles, on the other hand, does permit LIFO.

5. Why is LIFO better than FIFO?

LIFO is preferred over FIFO to help save tax and keep track of the latest financial records.

6. What Is LIFO Reserve?

The LIFO Reserve is the amount by which the company's taxable income has been reduced compared to the FIFO method.

7. Where is the LIFO method used?

The LIFO method is implemented in a scenario where higher revenue needs to be generated in an inflationary market to record lower income while saving taxes.