Sufficient cash flow is the biggest challenge most businesses face in a slow-moving economy. A lack of continuous cash flow can become a problem for your business's growth. It can also lead to the failure of operations that can affect the business's financial health. CCC or Cash Conversion Cycle is the solution to save your business from such situations.

In this article, you will learn more about the importance of the cash conversion cycle and its calculations in detail. By managing the cash cycle effectively, firms can handle working capital more efficiently and boost overall earnings.

What Is the Cash Conversion Cycle?

The cash conversion cycle is a measure that expresses the number of days that a company takes to convert its investment intoinventorygoods and services and other resources into cash from sales. It is also called the net operating cycle. It attempts to measure the total time for an operation to turn investment into cash.

CCC is an effective way to measure the financial health of your business. A decrease in CCC value is a good sign and shows the business is making profits faster. The cash cycle applies only to those departments that deal with inventory management and warehouse operations.

The cash conversion cycle measures the time the company takes to sell the inventory, collect money, and pay bills, including fines. It is a simple way to check the overall financial health of a business and identify delays. It is an insight into the company's financial goal management.

Cash Conversion Cycle Formula

The basic formula used by businesses to calculate is: CCC= DIO+DSO-DPO

Here, DIO= Days of inventory outstanding DSO= Days of sales outstanding DPO= Days of payable outstanding

DIO and DSO are the company's cash inflows. It is the amount the company receives when inventory is sold, and accounts payable is received by the company. DPO is a negative cash flow for the company. The bills and fines a company pays are subtracted from the cash inflow the company receives. DPO is linked to accounts payable; hence, it is a liability.

The formula to find DIO is: DIO= (Average Inventory / Cost of Goods Sold) x 365

The formula to find DSO is: DSO= (Average Accounts Receivable /Total Credit Sales) x365

The formula to find DPO is: DPO= ( Average Accounts Payable / Cost of Goods Sold) x 365

How to Calculate Cash Conversion Cycle?

Calculation of cash conversion cycle for a business helps manage financial goals and handle working capital better. It involves many vital elements essential for business inflow and outflow of cash. These few key items are crucial to maintaining a business's cash cycle. These items from financial statements include:

- Revenue and COGS or cost of goods sold from the income statement

- Inventory details before and after-sales

- Accounts Receivable or AR before and after-sales

- Accounts Payable or AP before and after-sales

- The total time or periods

Stage One

The first stage is when a business sells its inventory goods. It is called DIO or days Inventory outstanding. The lower the value of DIO, the better turnover the firm maintains. It is based on the cost of goods a company sells in a period.

DIO= (Average Inventory / Cost of Goods Sold) x365

The business should also have the Average Inventory value to find the DIO value.

Average inventory = ( BI+EI) / 2

Here, BI= Beginning inventory EI = Ending Inventory

Stage Two

The second stage includes the present sales and the company's time to collect cash. It is a measure called DSO or days of sales outstanding. A lower value for DSO is better, as the company has better capital in minimum time.

DSO= ( Average Accounts Receivable /Total Credit Sales) x365

To find the DSO value, businesses must have the average accounts receivable value.

Average Accounts Receivable = (BAR =+ EAR)

Here, BAR= Beginning Accounts Receivable and EAR= Ending Accounts Receivable

Stage Three

The third stage focuses on the bills or outstanding payables that a company pays, including fines or charges. It is calculated using DPO or days payable outstanding. A higher value of DPO is better for business as it means the company holds the cash for extended periods. A higher DPO also increases investment potential.

DPO= ( Average Accounts Payable / Cost of Goods Sold) x 365

The business needs average accounts payable to find the value for DPO.

Average accounts payable= (BAP + EAP)/ 2

Here, BAP= Beginning Accounts Payable EAP= Ending Accounts Payable

What the Cash Conversion Cycle Can Tell You

The primary goal for any business is to boost sales and earn more profits. The trade total time to attain profits is a longer cycle. That is why businesses opt for capital, which leads to more profits using inventory on credit, which results in accounts payable. With more cash, the company can use this extra inventory to improve revenue.

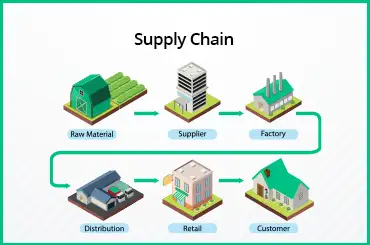

When a business sells inventory on credit, it results in accounts receivable or AR. Cash management in both accounts receivable and accounts payable is crucial. The cash conversion cycle is the lifecycle of a business's journey through all credits and debits a company uses. The timeline tells businesses the time it takes to convert inventory into cash.

The three vital elements of business include inventory management, sales, and credit payable. All these three are interdependent, and multi-level coordination helps businesses to run operations smoothly. The minimum CCC value allows companies to operate smoothly and boost overall turnover in minimum time.

The financial decisions about accounts payables and receivables explain a company's objectives and its management of liabilities and short-term asset management. A business that understands demands and minimizes liquidity risks can succeed with proper strategy.

How to Use Cash Conversion Cycle?

The Cash Conversion cycle has numerous applications in many industries. Businesses with negative CCC can hold cash for long periods, while companies with positive CCC involve buying and managing inventories for sales. CCC is only applicable to industries that operate large warehouses and inventories.

Companies that deal with software, insurance, or brokerage don't manage stockpiles, so CCC doesn't apply to them. Businesses like online stores and e-commerce can measure CCC as dealing with goods sales and managing inventory. Also, they have a negative cash cycle. They sell products using third-party sellers and wait to pay them. Therefore, they can hold cash for more periods and have better cash flow.

Improve Your Financial Health With TranZact

TranZact helps businesses reduce cash cycle time and improve financial health. With better management of working capital and higher profit margins, companies can increase the profitability of their operations. With TranZact, transform your business with a reduced cash conversion cycle and experience increased return on investments in minimum time.

FAQs on Cash Conversion Cycle

1. What does the cash conversion cycle measure?

The cash conversion cycle measures the business's performance and productivity. It is a measure that explains the periods in which companies can transform inventory into cash.

2. Why is the cash conversion cycle important?

The cash conversion cycle is essential to understand any business's performance. With shorter CCC, companies can generate cash in minimum time, making them more profitable.

3. How can inventory turnover affect the cash conversion cycle?

A quicker inventory turnover decreases the cash cycle. Therefore, a better inventory turnover is positive for the company's overall performance, productivity, and CCC.

4. How do we reduce the cash conversion cycle?

The companies can reduce their cash conversion cycle by converting inventory into cash quickly. The faster goods are sold, and money is collected, the lesser the ccc will be. Also, delaying days payable outstanding or DPO can help businesses reduce CCC.

5. What is the meaning of a negative cash conversion cycle?

The negative cash conversion means a business receives cash before selling the product. In this, the online seller has received payment before delivery of goods.

6. What is the main difference between operating cycle and cash conversion cycle?

The operating cycle is the number of days from buying inventory to the customer paying for the goods. At the same time, the cash conversion cycle includes payment of inventory goods by the company till getting paid by the customers for goods.