Inventory cost accounting helps with optimal resource management and smart decision-making. This article guides you in understanding the basics of various inventory accounting methods and their key role in improving your business's financial health.

The Basics of Inventory Accounting With Practical Examples and Expert Advice

Understanding the basics of Inventory accounting involves tracking and managing a company's stock of goods. It includes knowing inventory's value and flow to help manage cash flow, profitability, and customer satisfaction. The coming sections will focus on how inventory cost accounting catches discrepancies and avoids overstock or stockouts with expert advice on which accounting method is best for the businesses.

Define Inventory Costing

Inventory costing, or inventory cost accounting, involves assigning costs to products, including additional expenses like storage, market changes, and administration.

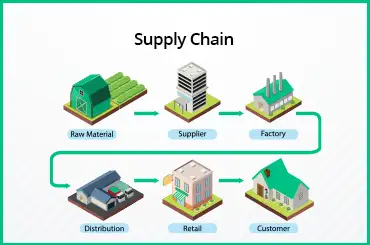

Inventory costing is a key part of inventory control techniques. Good inventory control in a supply chain lowers overall inventory expenses and aids in calculating the right product quantities a company should hold.

Methods for Costing Inventory

There are various methods for doing inventory costing methods accounting:

- First In, First Out (FIFO): Companies focus on selling the inventory they purchased first.

- Last In, First Out (LIFO): Companies tend to sell the inventory they bought most recently.

- Weighted average: Calculates the average cost of all units.

- Specific identification: Identifies and tracks each unit's actual cost.

Average Cost Inventory Method or Weighted Average Inventory Costing

The weighted average inventory costing method, also called the average cost inventory method, is a GAAP (generally accepted accounting principles)-approved technique companies use to calculate the value of their stock.

This approach measures the cost per unit by taking a weighted average of the price of goods sold and the inventory.

The formula of WAC is: Weighted Average Cost (WAC) = Total Cost of Goods Sold / Total Units Sold.

Assumptions for Inventory Cost Flow

Accountants use inventory cost flow assumptions for inventory cost accounting background before reporting inventory costs as cost of goods sold.

| Assumptions | What it means | When it is used | Impact on Financial Statements |

|---|---|---|---|

| Last in first out (LIFO) | Companies assign the latest costs to inventory for COGS. | During inflation (high COGS and low taxable income) | Lower inventory costs in the balance sheet, lower shareholder equity, higher COGS, and lower income in the income statement |

| First in, first out (FIFO) | Companies compare the oldest cost with revenue for COGS. | During inflation (low COGS and high taxable income) | Balance sheet - Accurate (higher) ending inventory value; the Income statement - Higher net income. |

| Weighted average cost (WAC) | Average cost for each unit during a specific period, calculated by dividing the total cost of items available for sale by the total number of units available for sale | Big companies with higher volume and inventory turnover | With rising prices: Higher average costs, lower net income. |

| Specific Identification (SI) | Keeps track of individual items in inventory. | One-of-a-kind items with high-value | Effect on net income varies based on acquisition costs and items sold. |

Choosing an Inventory Cost Accounting Method

When selecting an inventory control technique in cost accounting, companies must consider how the above methods affect their balance sheets and income statements. Using the same method each year guarantees fair reporting and correct tax payments.

Whatever method you choose, ensure COGS plus ending inventory matches the available goods cost.

Inventoriable Costs

Inventoriable costs make up the complete cost of a product. They cover all the basic steps to prepare items for inventory and possible sale.

It includes raw materials, production overhead, labor, inbound shipping, storage, and specific administrative expenses.

Inventory Holding Cost

Inventory holding costs or carrying costs refer to expenses linked with keeping unsold inventory. These costs include storage area, stock management, potential loss if items become obsolete or damaged, and the capital invested in unsold inventory.

Inventory Carrying Cost Formula

Calculating holding or inventory carrying costs offers various methods, including using a percentage of your inventory's value. However, this inventory cost formula helps tally up inventory's value quickly. Formula: Inventory Carrying Cost = Average Inventory Value X Carrying Cost Rate

The Formula for Inventory Costs

This formula includes starting and ending inventory values along with purchase costs within a timeframe. To calculate inventory cost, follow this formula: Inventory Cost = Beginning Inventory + Purchases - Final Inventory Value.

Standard Cost Inventory

Standard costing involves assigning anticipated (or standard) costs for labor, materials, and overhead to inventory, as compared to the real costs. This method helps in cost management, budgeting, and measuring a company's cost control performance.

It's a valuable tool for managing and reducing expenses.

Cost of Ending Inventory

The value of unsold items in stock by the period's end is called the cost of ending inventory. To calculate it, simply add the beginning inventory to any new purchases and then subtract the cost of goods sold.

It reveals what's still available for sale.

Simplify Inventory Cost Accounting Method With TranZact

TranZact offers a user-friendly solution to simplify your inventory cost accounting methods. By using TranZact's inventory management software, you can easily manage and track your inventory costs, making the process smoother and more manageable.

FAQs on Inventory Cost Accounting

1. What is inventory cost accounting?

Inventory cost accounting is a method to track and manage the expenses associated with maintaining and storing goods in the inventory.

2. Why is inventory cost accounting important?

Inventory cost accounting is important because It helps businesses understand their expenses, plan budgets, and make informed decisions about pricing and production.

3. What are the things included in inventory costs?

Things that are included in the inventory cost are materials, labor, and overhead expenses related to producing and storing inventory.

4. How do I calculate the cost of ending inventory?

To calculate the cost of ending inventory, you can add the beginning inventory to purchases and then subtract the cost of goods sold. The result is the value of unsold items or ending inventory.

5. What is the purpose of standard costing?

The purpose of standard costing is to assign expected costs to inventory items, aiding in budgeting and cost control.

6. What's the difference between FIFO and LIFO methods?

The main difference between FIFO and LIFO is that FIFO assumes selling the oldest items first, while LIFO assumes selling the newest items first.

7. How do I calculate holding costs?

You can calculate holding costs by adding current holding costs, dividing by total inventory value, and multiplying by 100 for a percentage. The formula is: Holding Costs (%) = (Current Holding Costs / Total Inventory Value) X 100