Here's your chance to learn about what is opening stock in detail, know how to find opening stock, determine opening stock debit or credit values and discover how you can calculate it accurately. The quantity and worth of materials a business has available for use or sale at the start of an accounting period is known as opening stock. It may take many forms, including raw materials, works-in-progress (WIP), or finished commodities.

What Is Opening Stock in Accounting?

Opening Stock is the quantity and cost of goods a business has available for purchase or usage at the start of an accounting period. The opening stock in balance sheet of the current accounting period is usually derived from the ending stock of the preceding accounting period, based on the nature of the business. It is the quantity and value of raw material, work-in-progress, and finished goods that are on hand at the beginning of each calendar year for an entity that uses the calendar year as its accounting period.

Types of Opening Stock

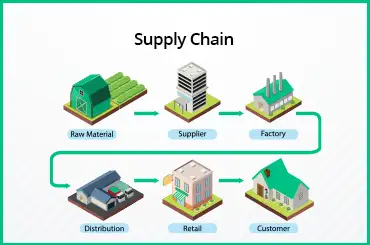

Within the industrial sector, different inventories are carried out depending on the company's business type. A manufacturing company will have a diverse inventory list, unlike a service provider. Broadly, finished goods, work-in-progress, supplies, obsolete materials, and raw materials are the five categories of inventory that can be used to classify a company's stock.

Raw Materials:

It's the inventory of essential materials used to make finished commodities, and it's the first type of stock every company has. Raw materials can also be of two types - perishable and nonperishable, depending on the final product to be produced.

Work-in-Progress:

Products that still need to be considered finished goods but have previously gone through some procedures are known as work-in-progress, or WIP, and are most often utilized by manufacturing companies for modification, conversion, or transformation. The work-in-progress inventory stage lies in between raw materials and finished goods.

Finished Goods:

This type of merchandise is finished and available for sale by the business. The stock of finished goods is maintained in the business based on demand trends.

Obsolete Stocks:

Obsolete stock is the stock of goods no longer in demand because of aging, altered designs, or other circumstances. Oftentimes due to market trends as well, certain goods are no longer useful for sale.

Supplies:

This is a list of non-perishable items like labels, fasteners, and packing supplies used during production. They are not directly used in the production process but are used as supporting resources.

The Formula for Calculating Opening Stock

Calculating opening stock and management of opening stock in trial balance is easy and straightforward. It can be calculated in various ways depending on the availability of data. The following are some formulas to calculate it:

Case 1: When various opening stock kinds are specified.

Raw Material Cost + Work in Progress Values + Completed Products Cost = Opening Stock Formula.

Case 2: When data for sales, cost of products sold, and gross profit are provided combined with current year closing stock:

Opening Stock formula = Sales - Gross Profit - Cost of Goods Sold + Closing Stock

Examples of Opening Stock

Example 1: The maker of furniture tables, XYZ Co., provides the following information regarding stock held as of January 1, 2022. Let's determine the opening stock value with classification as raw material, WIP, or finished goods based on the information provided:

Total raw material costs include Rs. 5000 for raw cotton, thread for Rs. 2000, and shades for Rs. 3000. The total cost for half-stitched shirts is mentioned as Rs. 20,000, shirts that are stitched but not colored for Rs. 15,000 and Rs. 40,000 for completed shirts.

Solution:

Total raw material value = Rs. 10,000 (5000 + 2000 + 3000) Total WIP goods value = Rs. 35,000 Total finished goods value = Rs. 40,000 Using the information, here is how the opening stock journal entry will be determined:

We will get the opening inventory using the following formula Raw Material Cost + Work in Progress Values + Completed Products Cost = Opening Stock

10,000 + 35,000 + 40,000 = 85,000.

Example 2 - A bookstore has the following details available in its books: Sales are Rs. 750,000, Sales Returns is Rs. 30,000. The Cost of Goods Sold is Rs. 450,000. Total Purchases is Rs. 270,000 and Closing Stock is Rs. 225,000. Gross Margin is Rs. 270,000.

Solution: Using the formula, the opening stock can be calculated as follows:

Opening Stock = Sales - Purchases - Gross Margin + Closing Stock Opening Stock = Rs. 720,000 - Rs. 270,000 - Rs. 270,000 + Rs. 225,000 Opening Stock = Rs. 405,000

Advantages of Opening Stock

Opening stock is the cost of the items offered for sale at the start of an accounting period. The benefits of opening stock are that it gives a clear image of the starting inventory and makes it possible to follow the inventory levels more accurately during the accounting period. It allows the company to spot out-of-date or slow-moving inventory and take the appropriate corrective action. Since opening stock is recorded on the debit side of Profit and Loss account, it aids in calculating the period's gross profit and cost of goods sold and supports stock-level management and inventory cost reduction. It also helps with assessing the effectiveness of the company and scheduling upcoming inventory purchases.

Limitations of Opening Stock

Opening stock assessment does have certain drawbacks. One of them is holding charges, as stocking up on inventory makes businesses spend more on storage, lowering their profitability. Because market conditions change, opening stock risks becoming out-of-date when stockpiles are not sold. As a result, it may become difficult to sell the inventory over time since it may become useless.

Investors are warned that businesses with high opening inventories must move stocks more quickly to transform them into sales. The financial accounts of firms will reflect poorly on this. Thus, management needs to pay special attention to the management of opening stock goods.

Why Is Opening Stock Debited in the Trading Account

Opening stock in trading account appears on the debit side of the Trading and Profit and Loss account because it contributes to the cost of sales for the current accounting year. The cost of products utilized from the stock on hand is calculated by subtracting closing stock from opening stock. To reflect how much stock is used for sales during the year, the opening stock is debited, and the ending stock is credited.

Important Points

- Since opening stock is the baseline from which the cost of goods sold is calculated, it must be appropriately recorded in the company's books.

- All inventories used in creating a company's goods must be considered because they directly impact the income statement and balance sheet.

- Opening inventories are also employed in calculating average lists and the inventory turnover formula, two crucial financial metrics.

- There are numerous modifications in opening stock calculation and disclosure requirements due to various amendments to guidelines, accounting assumptions, and accounting standards.

- Other assets like spare parts and capitalized asset inventory are also listed as inventory, in addition to the company's products.

Get Accurate Opening Stock Calculation Inputs With Tranzact

In essence, the stock accounting procedure includes opening and closing stock. Businesses must also be mindful of the hazards of holding excess stock, such as high carrying costs and the danger of obsolescence. TranZact integrates quotations, sales, purchases, inventory, and production data on a centralized cloud dashboard to provide you with all the required information at one glance. TranZact also offers integration with Tally and BUSY to ensure seamless accounting integration and calculation of important financial values such as opening stock, closing stock, inventory valuation, and more.

FAQs on Opening Stock

1. Is opening stock a liability or asset?

Opening stock is an asset as it refers to the value of the inventory that a company has in stock at the beginning of an accounting period. It includes all the goods or products that are available for sale or for use in the production process.

2. What distinguishes opening stock from closing stock?

The main difference between opening stock and closing stock is the point in time at which they are valued. Opening stock is valued at the beginning of an accounting period while closing stock is valued at the end of the period.