End-to-end knowledge about what invoice processing is crucial for SMEs to accomplish seamless operations. When an invoice is received from a supplier, it must go through a series of checks and balances before it can be paid and recorded in the general ledger. This is an essential component of managing a company.

Failing to make regular payments to your vendors due to issues with your billing and invoicing process may result in legal action being taken against you in order to protect their financial interests.

If you're unfamiliar with invoice processing and how to go about it, you've come to the right place. Keep reading to learn more about what is invoice processing and how to process invoices seamlessly with the software.

- What Is Invoice Processing?

- Invoice Processing Workflow

- How to Process Invoice for Payment?

- What Is the Journal Entry for Invoice Processing?

- How to Enter an Invoice Into the Accounts Payable System?

- Invoice Processing Automation

- Benefits of Automated Invoice Processing

What Is Invoice Processing?

Invoice processing is the sequence of actions taken from the moment a supplier invoice is received until the time it is paid and recorded in the general ledger.

No matter what format an invoice arrives in, paper, PDF, or electronic, it must be scanned and entered into your accounting software either manually or automatically. After that, the invoice is approved and paid according to a predefined protocol.

By effectively managing the invoice processing workflow, companies can improve their efficiency, accuracy, and control over their accounts payable function, and combat challenges in invoice processing. In essence, invoice processing refers to the series of steps involved in handling and managing incoming invoices from suppliers or vendors. These steps have been explained in detail below.

Invoice Processing Workflow

The steps involved in invoice processing workflow are as follows:

Receiving an invoice

The moment an invoice arrives, the first stage in its invoice processing cycle may begin. Suppliers or vendors can send invoices to customers in a variety of forms, from paper to portable document format (PDF). Invoices are received by the accounts payable department and must be processed in a uniform manner before being recorded in the general ledger.

Checks for accuracy

As invoices are digitized, they may be cross-referenced with purchase orders and delivery confirmations to verify their legitimacy and accuracy. If there are discrepancies between the totals on the invoice and the purchase order or delivery receipt, the process will halt here.

Acceptance of invoices

Assuming the invoice has accurate information, it can be forwarded to the appropriate department for final payment approval. Approval procedures may differ slightly from company to company but are often handled electronically these days. Invoices are less likely to get misplaced or forgotten this way.

Reimbursing the vendor

Now that the invoice has been recorded and accepted, the next step may begin: sending payment to the vendor. Each payment will be processed in line with the conditions agreed upon with the relevant supplier, with early payment plans being used where applicable to maximize savings.

How to Process Invoice for Payment?

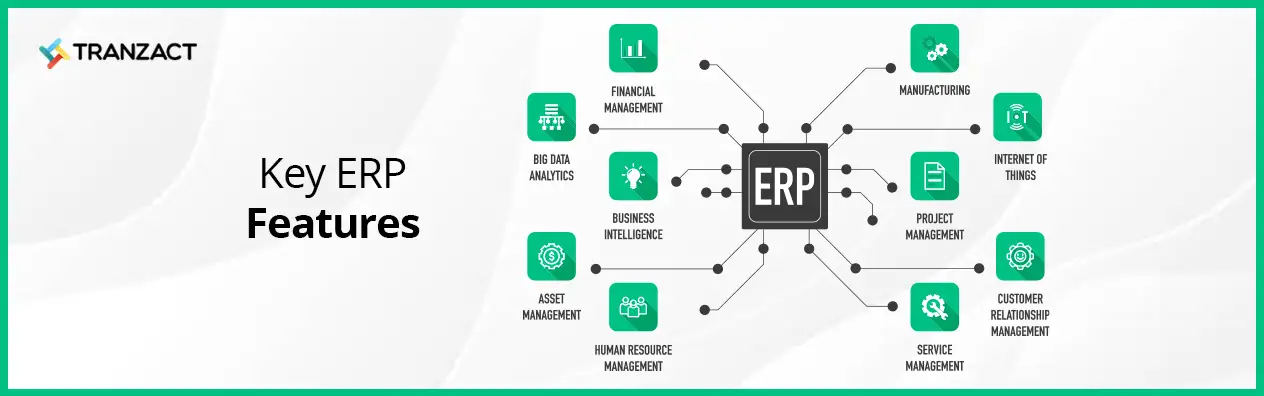

There is more than one stage involved in the billing and invoicing process, beginning with its receipt and continuing through the enterprise resource planning (ERP) system's entry and the general ledger.

Although there are no universal invoice process steps, the following invoice processing steps are commonly used by businesses -

Receipt of invoice:

Invoices from vendors can be sent through expedited mail or as an attachment to an email. A bookkeeper must scan these invoices and enter the data into the books. A duplicate of this invoice is produced for the sake of documentation.

Verification:

The business double-checks the information on the invoice with the information on the purchase order and the shipping documentation. The accounts payable and receivable departments, as well as the vendor, each receive a copy of these papers.

Submit for approval:

After initial validation, bills are routed to the proper approver, often the controller or the chief financial officer's (CFO) team.

Handling the money:

Payments are processed using the provider's bank account details. Bank transfer, NEFT, IMPS, or wire transfer are the recommended methods of payment. Mobile wallets and unified payment interfaces (UPI) have emerged as alternative payment methods in recent years.

Coding for the general ledger:

Accounts payable managers finalize the billing and invoicing process by entering invoice information into a general ledger (GL) system (usually an ERP) for future audit purposes.

Removal from balance sheets:

Once the invoice has been settled in GL, the cash payment will remove the credit from the 'accounts due' on the balance sheet.

What Is the Journal Entry for Invoice Processing?

A vendor's invoice, once received, must be recorded in your company's books. Accounts payable (AP) appear on the balance sheet as a liability and are typically deducted as an operating expenditure in the income statement when a company issues an invoice.

How to Enter an Invoice Into the Accounts Payable System?

Invoices may be entered into the accounts payable system by following these five simple steps:

- Upon acceptance of the invoice, the amount due should be recorded as a credit to the appropriate accounts payable account in the general ledger.

- When an item is added, it becomes an "open invoice."

- If you're paying an invoice in accordance with its conditions, enter the due date here (consider taking any discount opportunities that have been provided).

- Subtract it from the relevant accounts. While most AP items will show up as costs on the income statement, there may be times when an offsetting entry needs to be made to prepaid assets or fixed assets.

- Accounts payable debits cash to reflect the payment of open invoices, and cash is credited in the same amount.

Invoice Processing Automation

It takes a lot of time, money, and room for error to handle invoices manually. Without automated invoice billing processes and accounts payment operations, businesses may encounter high costs.

Accounting departments gain the following benefits by automating the invoice management process:

- Improve the speed with which invoices are processed from suppliers on a regular basis.

- Don't risk having to track down vendors or start from scratch to get replacement invoices because you misplaced them.

- Reduce or do away with the penalties that suppliers impose for late payments.

- Several businesses will reduce their invoices by a percentage if you pay them within 10 to 15 days of when you get them.

- Eliminate the need to manually enter data into numerous systems, which wastes time and resources.

- Maintain beneficial connections with your suppliers in this age of constant connectivity.

- Make sure that payments are made to suppliers on time and that goods and supplies are arriving to your organization as planned.

- Prioritize initiatives that will have a greater impact on the company's bottom line, versus repetitive data-entry tasks.

Benefits of Automated Invoice Processing

The benefits of automated invoice generation process are as follows:

Updates in Real Time

When invoicing is computerized, a timestamp is appended to each invoice. After an accounting transaction has been authorized, no further adjustments may be made.

Data Retention and Management in a Digital Environment

Invoices for sales may be easily consolidated into one digital repository with the help of automated invoicing. It allows a group to track money coming in and going out at any time, from any location.

Systematized Control Panel

By storing invoice information in one place, AP may easily access accounting data regardless of where they are or when it was created. Duplicate invoices and payments may be avoided with the use of billing and payment automation software.

Effective Communication

When accounts payable are computerized, critical data is reliably recorded in one place. You may use this information to make comparisons, generate reports, identify trends, and even predict future sales.

Streamline Your Invoice Processing With TranZact

Having understood what is invoice processing, and the key invoice process steps, you can now explore invoice automation software to streamline the buying process. This will help you to make the invoice route more transparent, cut costs, boost productivity, and strengthen relationships with suppliers.

TranZact helps you to computerize the invoice processing cycle and create GST-compliant invoices on a central dashboard. Therefore, your workers are freed up to focus on more strategic and creative endeavors. They, in turn, can increase the company's productivity and bottom line!

FAQs on Invoice Processing

1. How to improve invoice processing?

To improve invoice processing, you can switch to digital invoicing and automate the process. It's also important to track incoming and outgoing invoices and communicate with vendors about any changes to the invoicing and payment process. Additionally, training your staff on the invoicing and payment processes can ensure that they have the necessary skills to carry out their tasks efficiently.

2. What is invoice processing used for?

The invoice billing process is a part of accounts payable that includes processing invoices throughout their life cycle, from initial receipt to approval, payment, and archival.