Days Inventory Outstanding (DIO) is a crucial metric for any business with inventory. It measures the average number of days inventory is held before it is sold. But have you ever wondered how this metric could impact a company's financial performance?

If you want to learn more about how DIO can impact your business's financial health and how to calculate it, we have got you covered. In this article, we will delve deeper into the concept of DIO and its importance for businesses.

What Is Days Inventory Outstanding? (DIO)

Days Inventory Outstanding measures the average number of days the inventory stays in the company's vicinity before selling it. These are financial metrics that help to find the optimum ratio. These DIO average metrics are often known as inventory turnover days or inventory days.

In other words, Days Inventory Outstanding is how long it takes a company to turn its stocks into sales. It is an indicator of the company's financial efficiency and valuation. Using a just-in-time production system, allowing more inventory stockouts, and swiftly getting rid of any inventory it does not anticipate selling, all help a company reduce the number of days that inventory remains on hand.

DIO is an essential metric for businesses because it provides insight into the efficiency of their inventory management system. A high DIO means a company is holding onto its inventory for too long, which can tie up cash flow and increase the risk of inventory obsolescence. On the other hand, a low DIO means that a company is selling its inventory quickly, which can free up cash flow and reduce the risk of inventory obsolescence.

In addition, monitoring DIO can help businesses identify potential inventory management issues before they become significant problems. For example, a sudden increase in DIO could indicate a company experiencing slow sales, overstocking, or a supply chain disruption. Here are some examples of days inventory outstanding by industry types:

It is a critical metric that can provide insights into inventory management efficiency and help companies optimize their inventory levels. Here are a few examples of how DIO can be used in different industries:

- A manufacturing company has an inventory of Rs. 50,000 and a cost of goods sold (COGS) of Rs 500,000 per day. The DIO is calculated as follows:

DIO = (Inventory / COGS) x Number of days DIO = (Rs. 50,000 / Rs. 500,000) x 365 DIO = 36.5 days

In this example, the company takes 365 days on average to sell its inventory. This high DIO could indicate that the company produces more goods than it can sell, leading to excess inventory and increased carrying costs.

2. A food company has an inventory of Rs 20,000 and COGS of Rs 200,000 per day. The DIO is calculated as follows:

DIO = (Inventory / COGS) x Number of days DIO = (Rs 20,000 / Rs 200,000) x 365 DIO = 36.5 days

In this example, the company takes 36.5 days on average to sell its inventory. This high DIO could indicate that the company is holding onto inventory for too long, potentially leading to spoilage and waste.

The Impact of Days Inventory Outstanding on Business Operations

Days Inventory Outstanding (DIO) is a crucial metric that businesses use to evaluate their inventory management efficiency. Simply, it tells us how long a company holds onto its inventory before it sells it. A high DIO suggests that a company is holding onto its inventory for too long, resulting in increased storage costs, a higher risk of obsolescence, and reduced cash flow.

On the other hand, a low DIO suggests that a company is selling its inventory quickly and efficiently, which can result in improved cash flow and reduced inventory holding costs. In this article, we will explore the impact of DIO on business operations and how businesses can use it to improve their inventory management.

1. Impact on Cash Flow:

DIO has a direct impact on a company's cash flow. When a company holds onto its inventory for too long, it ties up cash that could be used for other business operations. A high DIO can also result in increased storage costs, further damaging a company's cash flow. By reducing its DIO, a company can improve its cash flow, making it easier to fund other business operations such as expansion, marketing, and hiring.

2. Impact on Inventory Holding Costs:

Holding onto inventory for too long can also result in increased inventory-holding costs. These costs include storage fees, insurance, and taxes. A high DIO can also increase the risk of obsolescence, resulting in inventory write-offs and further costs to the business. By reducing its DIO, a company can reduce its inventory holding costs and the risk of obsolescence.

3. Impact on Supply Chain:

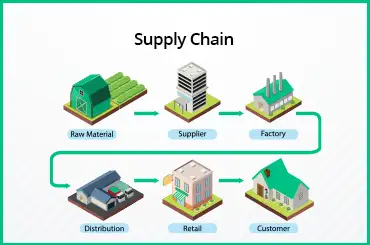

DIO can also have an impact on a company's supply chain. When a company holds onto its inventory for too long, it can result in delays in the supply chain and increased transportation and handling costs. A high DIO can also result in overproduction, which can strain the supply chain and increase costs. By reducing its DIO, a company can improve the efficiency of its supply chain, reducing costs and improving delivery times.

4. Impact on Customer Satisfaction:

When a company holds onto its inventory for too long, it may not be able to meet customer demand promptly. This can result in lost sales and reduced customer satisfaction. By reducing its DIO, a company can improve its ability to meet customer demand and improve customer satisfaction.

Read Also: What is HSN Code

How to Improve Days Inventory Outstanding?

To measure how long a company takes to sell its inventory, we measure Days Inventory Outstanding (DIO). A higher DIO indicates that a company holds onto its inventory for a longer period, which can tie up working capital and increase the risk of inventory obsolescence or damage.

To improve DIO, businesses must focus on improving their inventory management system. Here are some strategies that can help companies reduce their DIO:

-

Forecast demand accurately: Accurately forecasting demand is essential for maintaining the right inventory level. Businesses should use historical sales data, market trends, and other factors to forecast demand accurately.

-

Optimize inventory levels: Maintaining the right inventory levels can help businesses avoid stockouts and overstocking. Companies should use inventory optimization software to determine the optimal inventory levels for their business.

-

Streamline the supply chain: A streamlined supply chain can help businesses reduce lead times, improve delivery times, and minimize stockouts. Companies should work with their suppliers to improve lead times and reduce costs.

-

Implement Just-in-Time (JIT) inventory: JIT inventory is a lean manufacturing strategy that involves receiving goods only when needed in production. Implementing JIT inventory can help businesses reduce inventory levels, enhance efficiency and improve cash flow.

-

Use technology: Utilizing technology such as inventory management software can help automate and streamline inventory management processes, making it easier to track inventory levels, identify slow-moving items, and manage stock levels efficiently.

By implementing these strategies, a company can improve its inventory management, reduce DIO, and free up working capital.

Read Also: Proforma Invoice in Excel, Word, and PDF

How to Calculate Days Inventory Outstanding?

The formula for days inventory outstanding involves two components: average inventory and cost of goods sold (COGS).

For inventory days calculation, you first need to determine the average inventory. To do this, add the beginning and ending inventory for a given period, then divide the total by two. For example:

Average Inventory = (Opening Inventory + Closing Inventory) / 2

Next, you must determine the cost of goods sold for the same period. COGS is the direct cost of producing goods, including materials and labour. Below is the calculation of COGS:

Cost of Goods Sold = Opening Inventory + Purchases - Closing Inventory

Once you have determined the average inventory and COGS, you can calculate using the following days' inventory outstanding formula:

DIO = (Average Inventory / COGS) x Number of Days in Period

The number of days in the period can vary depending on the company's reporting cycle, but it is typically a quarter (90 days) or a year (365 days).

For example, let's say a company has an average inventory of Rs 500,000 and a COGS of Rs 1,000,000 for a reporting period of 90 days. The DIO would be:

DIO = (Rs 500,000 / Rs 1,000,000) x 90 = 45 days

This means that, on average, the company holds onto its inventory for 45 days before selling it. A high DIO suggests that the company is holding onto its inventory for too long, while a low DIO suggests that the company is selling its inventory quickly and efficiently. By monitoring and managing DIO, businesses can improve their inventory management efficiency and optimize their cash flow.

What Is a Good Days Inventory Outstanding (DIO)?

The ideal DIO can vary depending on the industry, the company's business model, and other factors, but in general, a lower DIO is considered better because it indicates that the company is efficiently managing its inventory and turning it into sales.

A good DIO depends on the company's specific circumstances, but as a general rule of thumb, a DIO that is lower than the industry average can be considered good. To determine the industry average, companies can use benchmarking data provided by industry associations or consulting firms, or they can compare their DIO to that of their competitors.

| Higher Days Inventory Outstanding (DIO) | Lower Days Inventory Outstanding (DIO) |

|---|---|

| When inventory takes too long to sell compared to similar businesses, it might mean the product isn't in demand, is priced too high, or the target audience needs reevaluation. | Typically, a shorter DIO is seen positively as it suggests the company sells its stock efficiently without hoarding too much. |

| The business might struggle to turn inventory into sales. This could be due to weak marketing or not standing out in its market. | A company with a short DIO quickly turns its stock into earnings, freeing up funds for reinvestment or debt repayment. |

| In extreme cases, the product might be outdated, requiring heavy discounts to sell, or even leading to a loss on unsold stock. | However, businesses with very low DIO could face challenges if there's a sudden spike in demand. Running out of stock means missed opportunities for sales. |

For example, let's say a company operates in the retail industry, and the industry average DIO is 60 days. If the company's DIO is 50 days, it could be considered good because it is lower than the industry average. On the other hand, if the company's DIO is 70 days, it could be considered high, and the company may need to investigate ways to improve its inventory management efficiency.

Read Also: What is Credit Note

Industry-Specific Applications of Days Inventory Outstanding

Days Inventory Outstanding (DIO) is a useful metric that can provide insights into inventory management efficiency for businesses across a wide range of industries. However, the specific applications of DIO can vary depending on the industry and the type of inventory being managed. In this section, we will discuss some industry-specific applications of DIO.

1. Retail Industry:

- DIO is crucial for profitability; inventory management directly affects it.

- High DIO: May mean too much inventory, leading to higher carrying costs and possible markdowns.

- Low DIO: Could indicate insufficient inventory, resulting in stockouts and lost sales.

- Application: Retail companies use DIO to fine-tune inventory levels, adjusting ordering and replenishment based on customer demand.

2. Manufacturing Industry:

- DIO assesses production efficiency.

- High DIO: Suggests overproduction, leading to excess inventory and higher carrying costs.

- Low DIO: May indicate insufficient production to meet demand, causing lost sales.

- Application: Manufacturing companies use DIO to optimize production schedules, procurement, and reduce supply chain waste.

3. Food Industry:

- DIO ensures freshness and quality of perishable goods.

- High DIO: Indicates potential spoilage and waste by holding perishables too long.

- Low DIO: Suggests not enough inventory to meet demand.

- Application: Food companies use DIO to balance inventory levels, adjust ordering, and minimize waste.

4. Healthcare Industry:

- High DIO: Could lead to increased carrying costs and waste due to expired supplies.

- Low DIO: May result in not having enough inventory, disrupting patient care.Application: Healthcare companies use DIO to manage inventory levels, procurement practices, and maintain necessary supplies and equipment for patient care.

Streamline Days Inventory Outstanding With TranZact

Days Inventory Outstanding is a crucial metric for any company that wants to effectively manage its inventory and improve its financial performance. To improve DIO, TranZact implements strategies such as optimizing order quantities, improving inventory forecasting, and reducing lead times. By doing so, companies can reduce excess inventory costs and improve cash flow!

Days Inventory Outstanding FAQs

Q1. What is the difference between Days Inventory Outstanding and Inventory Turnover Ratio?

The inventory turnover ratio measures how many times a company's inventory is sold and replaced over some time. On the other hand, Days Inventory Outstanding is a measure of inventory efficiency that calculates the number of days it takes for a company to sell its inventory.

Q2. How does Days Inventory Outstanding affect cash flow?

DIO can have a significant impact on a company's cash flow, as it affects the timing of cash inflows and outflows related to inventory. If a company's DIO is high, it means that it is taking longer to sell its inventory, and therefore, the company is tying up more cash in inventory. On the other hand, if a company's DIO is low, it means that it is selling its inventory quickly, and therefore, it is generating cash inflows more frequently. This can improve the company's cash flow, as it will have more cash available to use for other purposes.